The Operational Resilience of PE Firms

Private assets offer a safe harbor to today´s volatility in traditional 60/40 assets. The resilience of private equity in such environments is not a mirage due to mark-to-model valuations or a growth sector bias.

Private equity, thus, offers bottom-up operational resilience most valuable in the volatile and uncertain times that we face today.

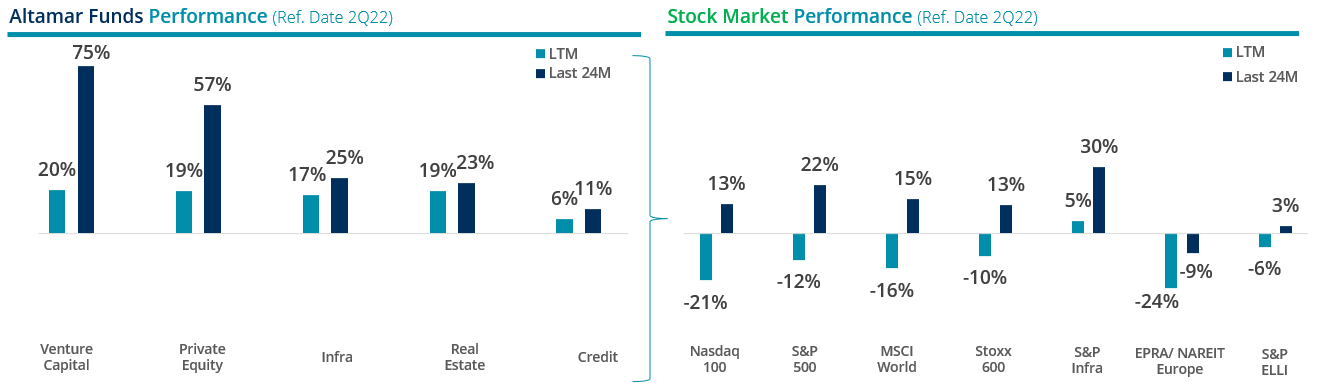

“Altamar Funds” data sourced from AltamarCAM’s fund portfolio. “Private Equity, Venture Capital, Infra, Real Estate and Credit: includes all primary and secondary funds managed by Altamar Private Equity, SGIIC SAU for each asset class.

Source: Data for Stock Market Performance obtained from www.Investing.com;

LTM: 30/06/2021 to 30/06/2022; Last 24M: 30/06/2020 to 30/06/2022.

As we all know well by now, these performance 3 numbers are not directly comparable:

- On the one hand, private assets are valued on a discounted cash flow and / or comparable companies methods (mark-to-model) whereas their public benchmarks are valued on a mark-to-market basis. There is thus a material lag on the time it takes private asset valuations to reflect an adverse market shock. This lag creates a smoothing effect on private equity returns.

- On the other hand, the sector exposures of private and public assets differ considerably and their relative performance may be significantly different. To illustrate, during the 12 months to June, the USD FTSE World Technology index4 dropped 23%, Telecoms 18% and Health Care 6% whereas the Energy index surged by 14% and Utilities by 1%.

Could there be other fundamental bottom-up reasons as to why private assets outperform public benchmarks during adverse market conditions?

In a Winter 2021 Journal of Alternative Investments article, Private Equity and the Leverage Myth, Czasonis, Kinlaw, Kritzman, and Turkington 5 explore the theoretical and empirical relationship between volatility and leverage.

Their findings:

- Volatility should scale directly with the degree of leverage.

- Investors usually estimate the volatility of private equity buyouts by applying a leverage multiple to public equity volatility.

- Even though private equity firms have twice the leverage of public equity, their observed volatility, even after adjusting for smoothing, is no greater than that of public equities.

- Leverage has, thus, no apparent effect on private equity volatility. There is no evidence that volatility scales with leverage.

We face a conundrum that would possibly challenge even Greenspan himself.

Czasonis et al undertook to understand the lack of statistical relationship between leverage and private equity metrics. After conducting time-series analyses and reviewing the financial conditions of several companies, they find that leverage is often stable for long periods of time, whereas volatility is highly time-varying, and companies have several sources of implicit leverage.

All in, Czasonis et al reach the stubborn conclusion that private equity volatility is similar to public equity volatility despite its higher leverage. As they explore why this is the case, they posit that “it could be that buyout fund managers prefer to invest in companies whose underlying business activities are inherently less risky and can therefore bear higher leverage, which increases profit”.

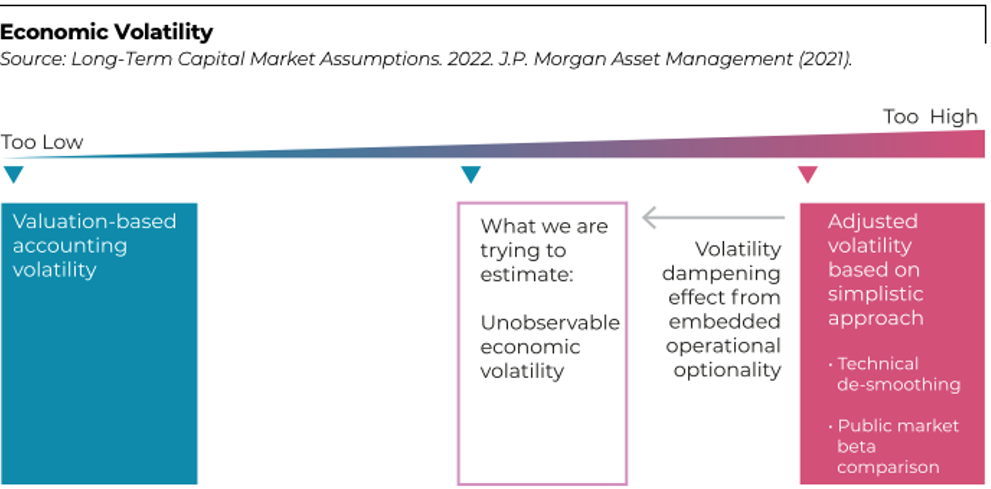

Consistent with Czasonis, J.P. Morgan has introduced this year, in its well-regarded Long-Term Capital Market Assumptions annual study, a novel approach to estimating private equity volatility reflecting the unique characteristics of private market assets – including the embedded operational optionality of private equity. This methodology leads to a dampening of estimated volatility:

-

1. Information obtained from funds managed by State Street Private Equity Index (page 23 of “Private Equity and the Leverage Myth”).

2. y 3. Past performance is not necessarily indicative of future results as current economic conditions are not comparable to past performance, which may not be repeated in the future. 4. Data sourced from FTSE All-World Index Series. Monthly review. June 2022

5. Megan Czasonis, William Kinlaw, Mark Kritzman y David Turkington

6. Long-Term Capital Market Assumptions (JP Morgan) & Private Equity and the Leverage Myth (Megan Czasonis, William Kinlaw, Mark Kritzman y David Turkington)

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.