Staying invested

Private investment exposures are driven by commitments, actual drawdowns, and underlying fund performance. As investors just control the size and timing of their commitments, they need to carefully consider what commitment strategy best serves their strategic purposes and is best aligned with their risk profile.

- This represents a base case based on the experience of AltamarCAM Partners. It is not an investment recommendation, and past performance is no guarantee of future returns.

- Further details can be found in page 35 under “Commitment Strategies”.

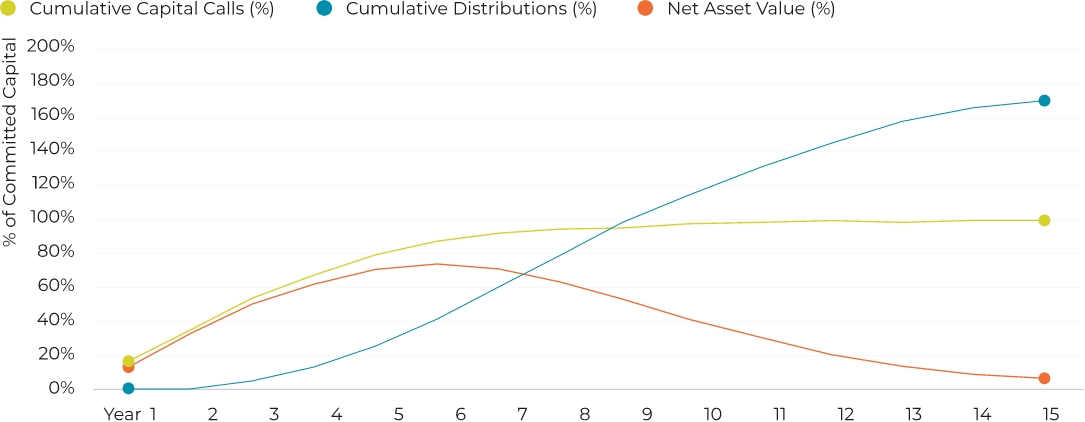

The Single Buyout Fund

Source: AltamarCAM Partners based on Preqin data

3. Base scenario elaborated on the experience of AltamarCAM Partners. This may not be realised in the future.

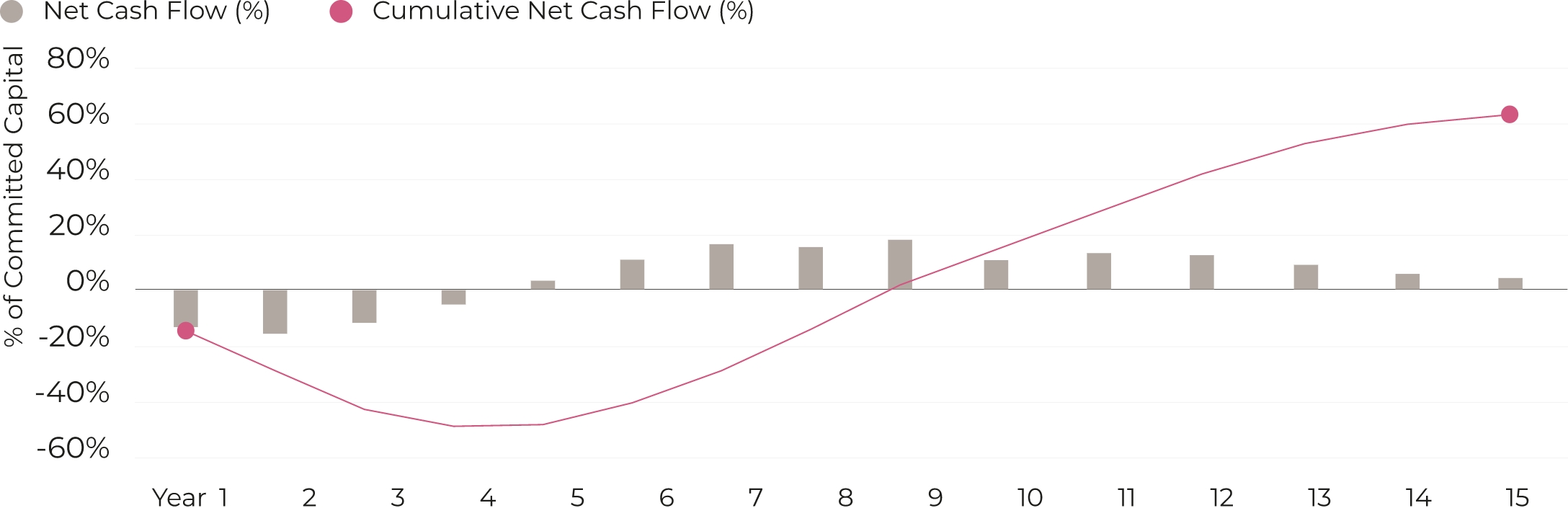

Commitment Strategy with Single Funds – 25% each quartile

Source: AltamarCAM Partners

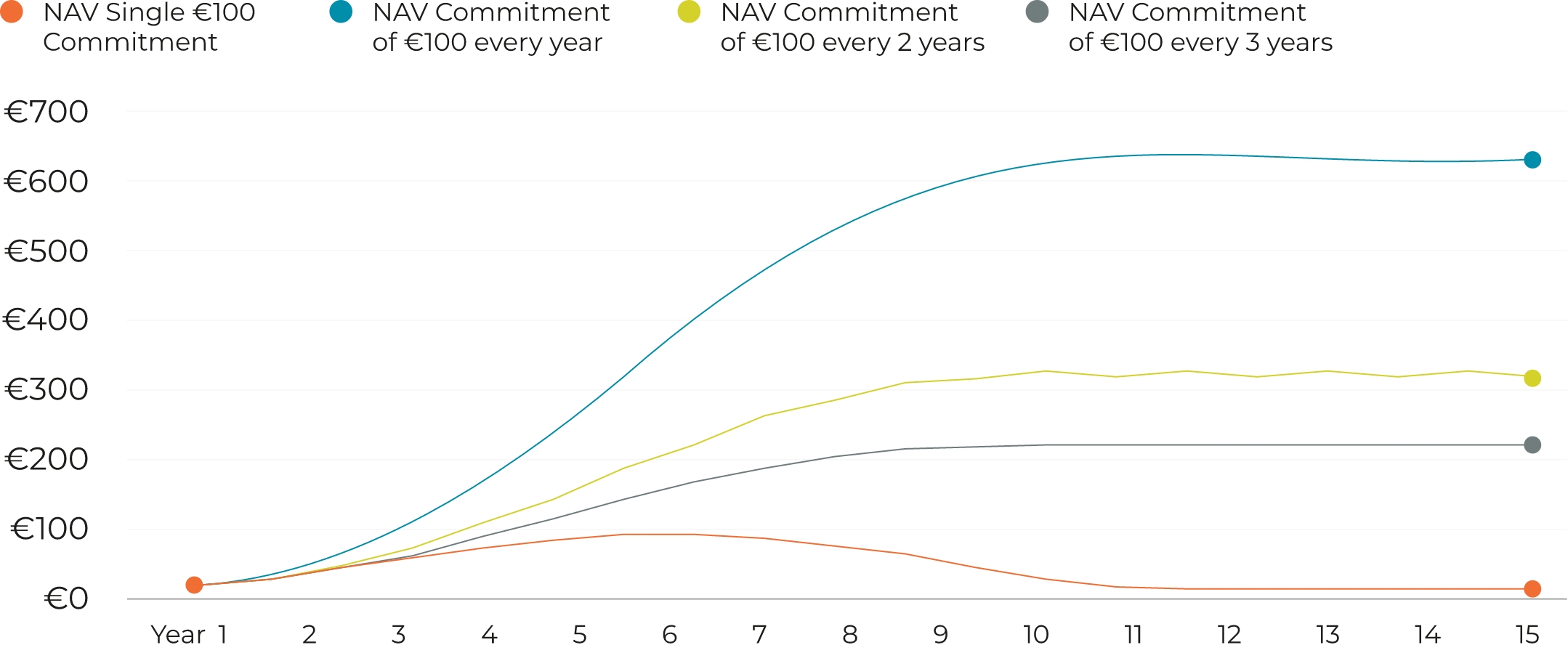

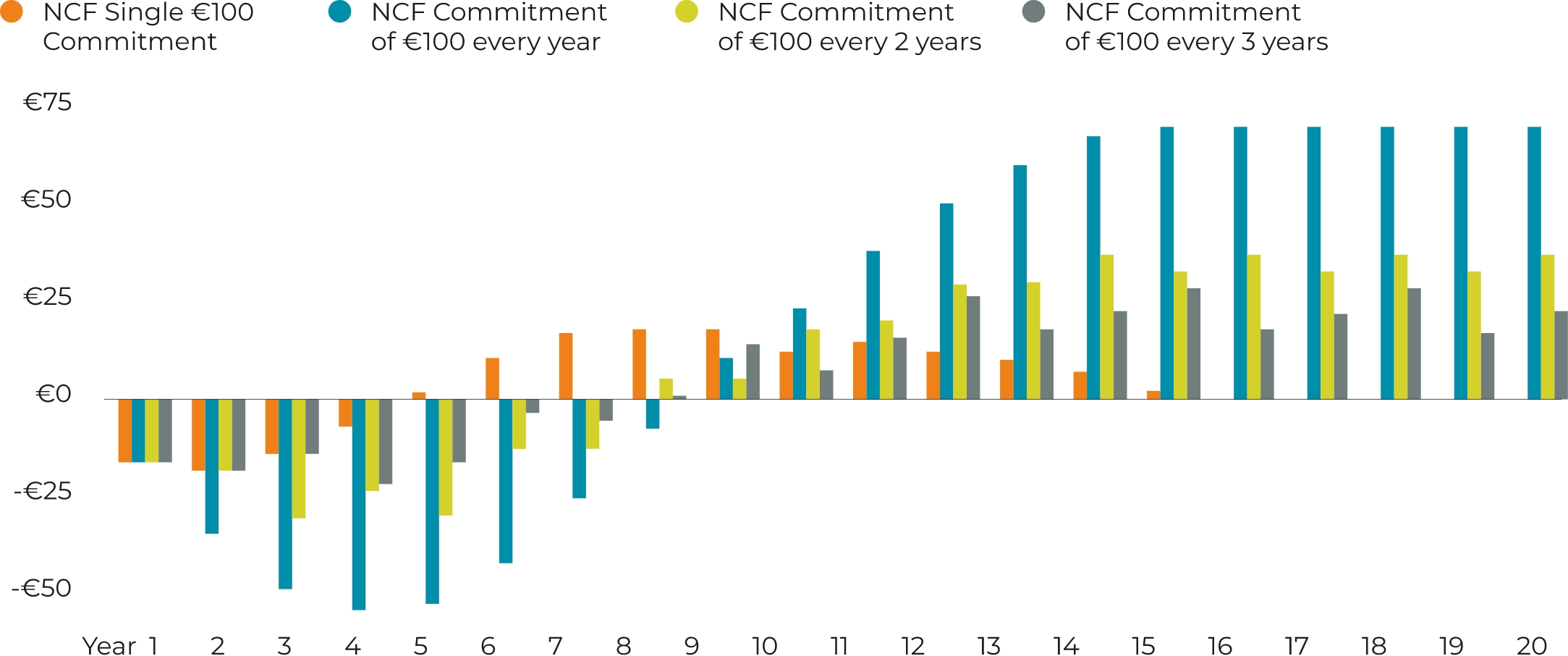

Investors may reach a target steady-state self-financing exposure by committing to invest, in round numbers, one sixth of the target exposure every year, one third every two years, or one half every three years.

As the last three strategies involve staggered investments, the desired exposure takes longer to build than by just committing the target amount at the outset, as in the previous example. However, once the target exposure is achieved with the three staggered commitment strategies, investors obtain annual positive net cash flows as long as the commitment strategy is maintained:

Commitment Strategy with Single Funds – Net Cash Flows

Source: AltamarCAM Partners

There are no shortcuts to building sustainable exposures in private assets. You need forethought and time to execute a staggered commitment strategy consistent with your unique portfolio goals and constraints.