Harvesting Illiquidity Premia in Credit

The traditional 60/401 portfolio is dominated by equity risk and term premiums. Investors stand to harvest additional sources of risk premia by moving out of a traditional 60/40 portfolio into private asset classes, even in a high interest rate environment. This risk premia could represent compensation in excess of the risk-free rate for bearing specific risks like illiquidity or complexity.

Private asset classes offer investors the ability to create a well-diversified portfolio of risk premia by including exposures to complexity and illiquidity premia in addition to capturing equity risk and term premiums. Illiquidity premia is highest2 in the middle of market turmoil as the one we are going through now.

In our white paper Targeting Private Equity we summarize the empirical evidence supporting the view that the high performance of private equity investments is derived from foregoing liquidity and allowing investment managers to focus on long-term value creation.

Another most interesting case is private credit, as we discuss in our white paper Targeting Private Credit. As familiar as we may seem to be with credit risk, both Cliffwater -a leading investment advisory firm- and AQR -a leading quantitative investment management firm- felt compelled to ask themselves just four years ago whether credit is an investable asset class:

- Cliffwater, in its paper Credit as a Separate Asset Class, reckons that “investors are just beginning to identify credit as a separate asset class … with favorable and sustainable return and risk characteristics that are differentiated from other asset classes”.

- AQR, in its paper The Credit Risk Premium, documents for the first time “the existence of a credit risk premium and its additivity to other known risk premia, e.g., the equity risk premium and the term premium”.

Private Credit Investment Strategies

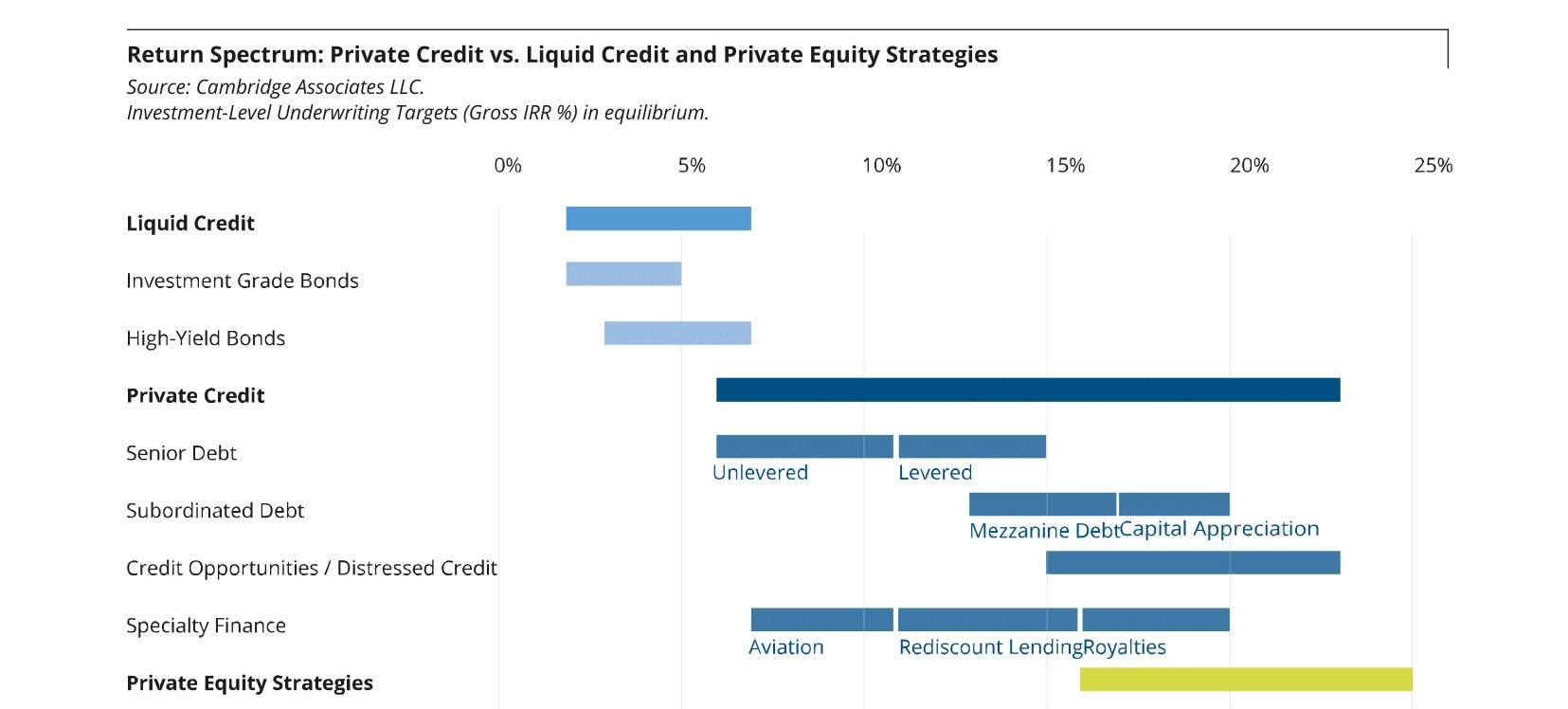

Private credit is a vast and deep universe of investment opportunities:

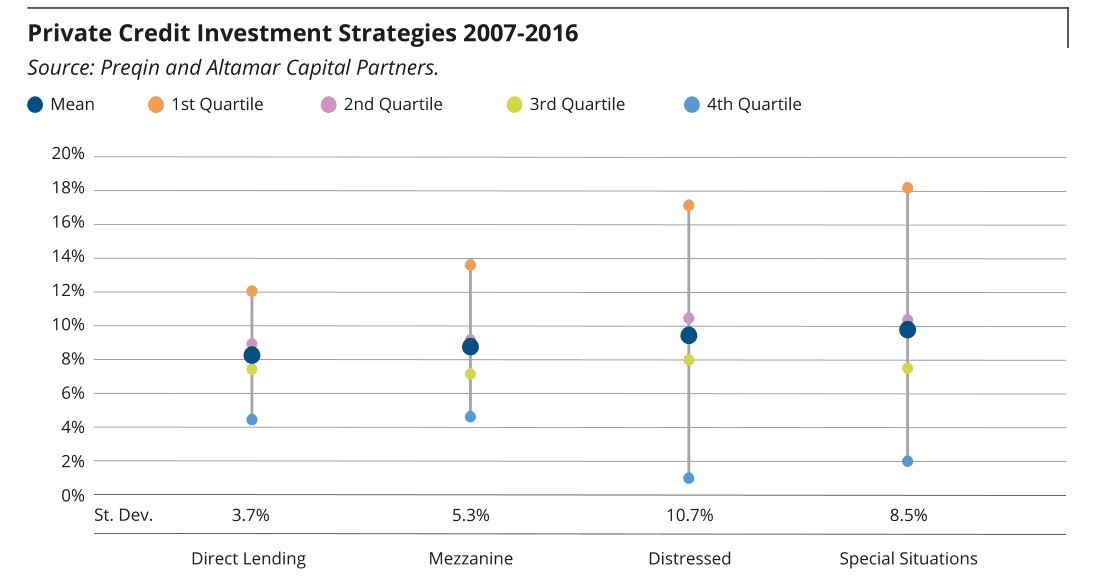

Preqin provides the following data for the performance of the four key investment strategies in the private credit space. Performance data is calculated as an internal rate of return and is net of fees and expenses:

Illiquidity, Complexity, and Uncertainty

Private credit instruments are exposed to credit risk and experience credit losses. Investors need to be compensated for them. In addition, investors are subject to illiquidity, complexity, and uncertainty to a degree not found in the large quoted markets for investment grade, high yield, and liquid broadly syndicated loans. Naturally, investors require additional compensation.

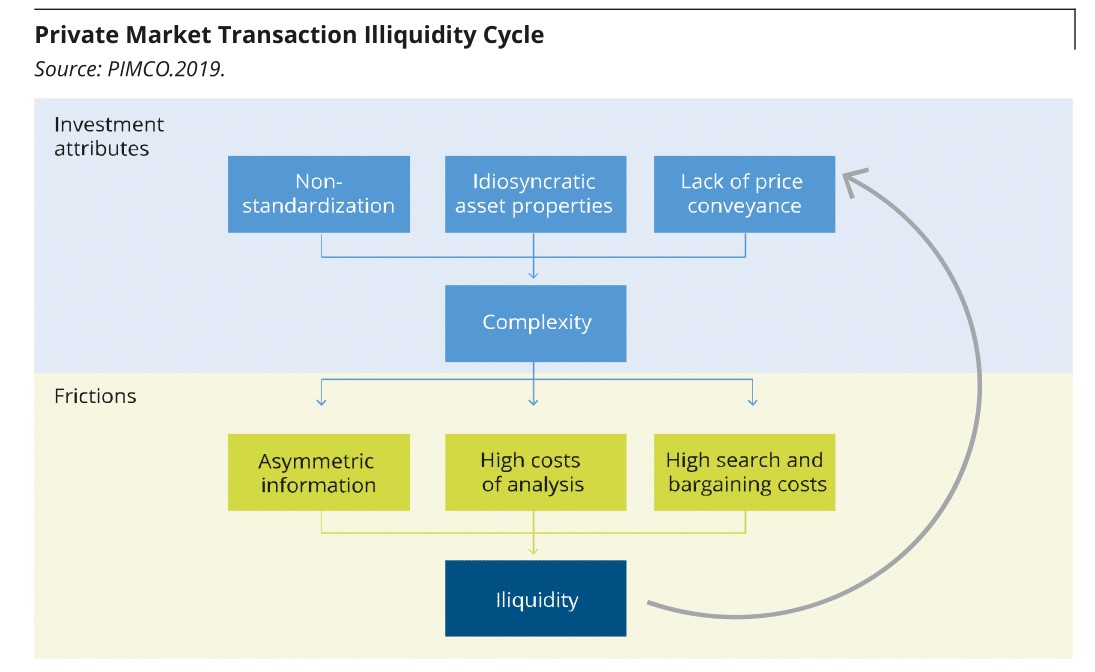

PIMCO has taken a dive into this matter and published a valuable paper Liquidity, Complexity and Scale in Private Markets. PIMCO develops a framework to integrate illiquidity and complexity. The additional return that investors require from patiently holding assets and foregoing alternative investment opportunities is the illiquidity premium. In addition, complexity must be considered too, as the complexity of an investment structure can also lead to illiquidity.

PIMCO presents the following conceptual framework for connecting complexity and illiquidity:

On the one hand, complexity stems “from certain attributes that can be unique to the private asset market: nonstandardization, idiosyncratic characteristics of the underlying investments, and the inability to rely on past prices because of infrequent transactions or the lack of information given the private nature of past transactions”.

On the other hand, supply and demand imbalances driven by high analysis and search costs “can cause significant delays between the transactions in private markets, leading directly to illiquidity. The result is a critical feedback effect: long delays between transactions mean that prices are often stale and thus only quasi-informational. This, in turn, creates complexity for future transactions.”

Illiquidity and Complexity Premiums

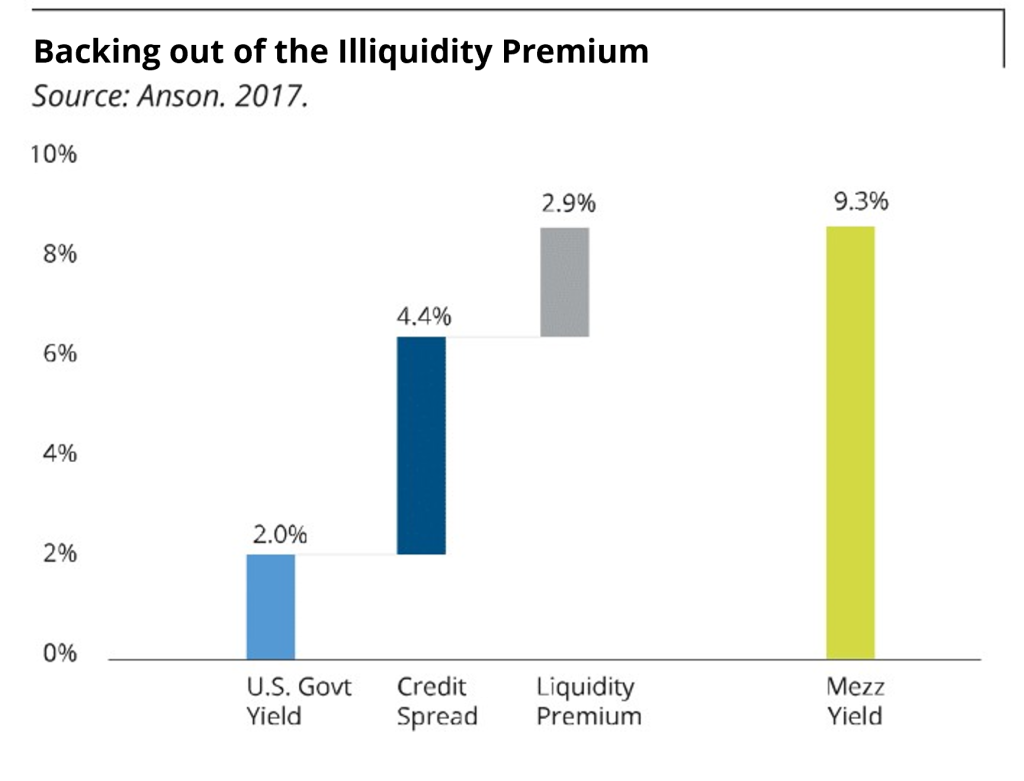

M. Anson, in Measuring Liquidity Premiums for Illiquid Assets examines how much of the return to illiquid assets is due to a illiquidity premium. Anson looks at Business Development Companies (BDCs). BDCs are US based funds that invest in the privately issued debt of below-investment-grade companies. Typically, this debt includes senior, subordinated, and mezzanine debt.

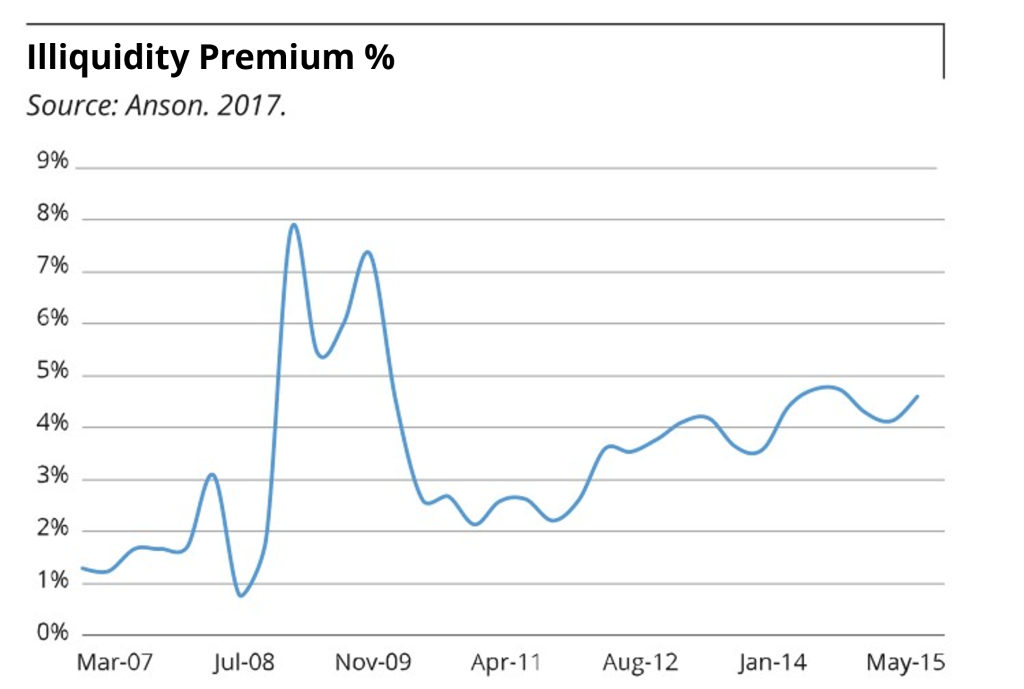

Anson builds a basket of BDCs and compares its return to a duration and option-adjusted series of US Treasury debt. Anson finds an illiquidity premium that, not surprisingly, fluctuates with the risk appetite in the market. This premium, in addition, “is a separate factor distinct from market beta, size, value, and momentum”:

Anson notes that “the illiquidity premium was very low prior to the Great Recession, only in the range of 1% to 2%. This is consistent with the overwhelming supply of liquidity and credit that flooded the market prior to 2008 … Private capital funds with vintage years 2006-2008 have done particularly poorly. There simply was too much credit and liquidity prior to the Great Recession … Not surprisingly, after the Great Recession, illiquidity premiums spiked up to 8% … Once stabilized, the illiquidity premium appears to be in the range of about 4% to 5%”.

To recap, savvy investors can create portfolios of risk premia that include potential compensations for business risk, term premiums, complexity, and illiquidity as in private equity or private credit. In addition, the premia offered by private assets can offer low or even negative correlations with that offered by traditional assets. This premia is highest3 in volatile, uncertain, and complex regimes as that lived in the aftermath of the collapse of Lehman.

1. Portfolio typically composed of 60% equity exposure and 40% fixed income exposure.

2. y 3. Past performance is not necessarily indicative of future results, as current economic conditions are not comparable to past performance, which may not be repeated in the future.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.