Asset Allocation in a Higher-for-Longer Interest Rate Environment

As a result of the unrelenting increase in yields to maturity since the summer of 2020, the expected rate of return of fixed income portfolios has improved considerably. The aggressive interest rate hikes seen over the past 12 months have also enhanced the return of short-term money markets.

We run mean-variance optimizations under a higher-for-longer interest rates regime. Allocations to private assets are not affected due to their low correlations with 60/40 assets and the illiquidity and complexity risk premia that they harvest.

We all wish we could be back to our traditional 60/40 allocations, earn real positive returns on our portfolios, and avoid answering tough questions. Unfortunately, our volatile, uncertain, complex, and ambiguous environment requires deep thinking and, surprisingly, some rather simple and well tested rules:

Investment Policy – Stay the course or reassess it but just do not chase performance or the crowd. As R. Ibbotson illustrates in his paper Does Asset Allocation Policy Explain 40, 90, 100 Percent of Performance?, investment policy explains over 100% of the long-term absolute rates of return of the portfolio. The excess over 100% is lost through active management.

We just updated our June 2022 white paper Targeting Private Assets with current money markets rates and bond yields to maturity, which are a good proxy of expected returns. Expected returns are important but so are correlations and volatilities.

Despite higher interest rates, the mean-variance optimizer still craves to allocate to private assets. It just replaces the allocation to assets capturing liquid risk premia like value and momentum with allocations to fixed income in the case of low volatility portfolios. In portfolios with economic volatilities above 5%, the optimizer maintains a full allocation to private assets.

Macro Bets – Current money market and bond yields in the US earn nominal rates of return below core inflation rates. For these assets to deliver positive real returns, you need immaculate disinflation. M. El-Erian1 assigns a probability of 25% to such a scenario. If inflation becomes sticky – his central scenario with a 50% probability – the real return of these assets will be zero. If we get “U Inflation”, these assets will be nailed. So, in this case you would just have a 25% probability of doing nicely buying bonds now.

Margin of Safety – We believe that strategic asset allocations should be modified on the back of the margin of safety that assets offer rather than on the back of unreliable forecasts as to where the economy will be over the next 12 months.

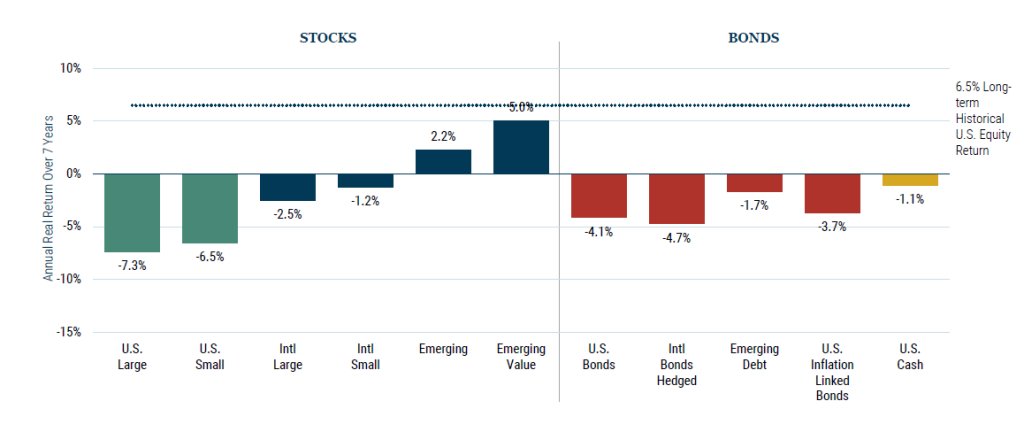

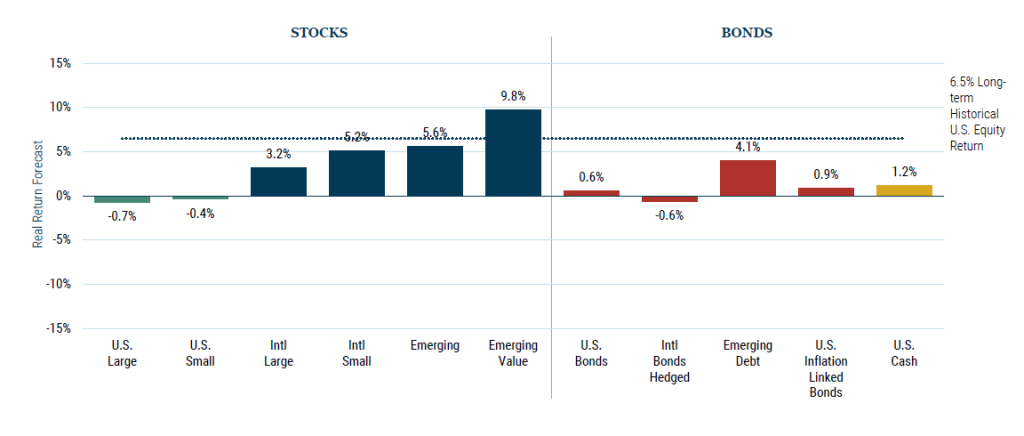

Jeremy Grantham provides precious insights in his seven-year forecasts of real returns for traditional 60/40 assets. Let’s look at the ones at year-end 2021 and 2022:

7-year asset class real return forecasts*

As of December 31, 2021

7-year asset class real return forecasts*

As of December 31, 2022

Source: GMO

*The chart represents local, real return forecasts for several asset classes and not for any GMO fund or strategy. These forecasts are forward-looking statements based upon the reasonable beliefs of GMO and are not a guarantee of future performance. Forward-looking statements speak only as of the date they are made, and GMO assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results may differ materially from those anticipated in forward looking statements.

U.S. inflation is assumed to mean revert to long-term inflation of 2.2% over 15 years for the graph as of December 31, 2021.

U.S. inflation is assumed to mean revert to long-term inflation of 2.3% over 15 years for the graph as of December 31, 2022

Investors that wisely and courageously underweighted bonds in 2022 did very well. Bonds were nailed during the year. As a result of the collapse in price and the increase in yields to maturity, expected returns are now largely positive although just barely so.

How much fixed income should you include in your portfolio? Clearly, more than a year ago. So, underweights should be reduced. Just reduced. Nevertheless, we would need higher yields to have a comfortable margin of safety to go neutral or even overweight.

In addition, investors are well advised to keep in mind that inflation is exceeding consensus forecasts and proving to be stickier than expected. Fixed income portfolios, thus, could still deliver negative rates of return over the next 12 to 18 months.

Harvesting Diversifying Risk Premia – By diversifying into private assets, investors reduce the overall volatility of the portfolio even if the private assets are marked to market, as JP Morgan does in its long-term capital markets assumptions studies, and we use in our forecasts. In addition, investors earn a complexity and illiquidity premium.

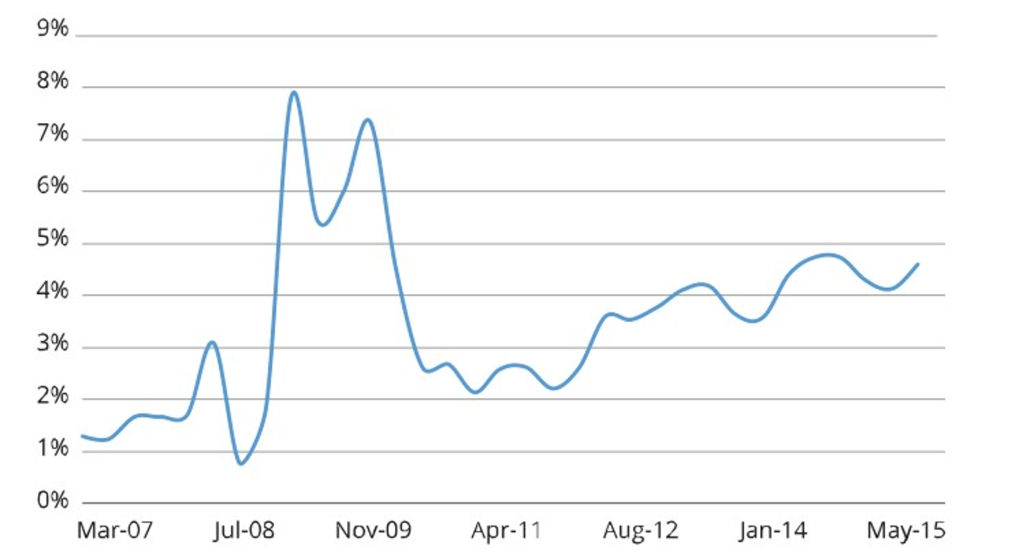

Illiquidity and complexity premia typically rise in an uncertain and risk averse context such as the current one. Existing investments may suffer a derating but the expected return for new investments will probably rise. Therefore, investors will need a higher premium for bearing complexity and illiquidity risks in a risk-off deeply uncertain environment.

In our update, we have kept this risk premium at about 2% versus their liquid equivalents. However, as Mark Anson explains in Measuring Liquidity Premiums for Illiquid Assets2, this premium fluctuates over time and is highest when markets conditions are most challenging:

Illiquidity premium %

Source: Anson (2017)

Investors with a robust investment process, including a sound investment policy and private assets commitment strategy, should stand firm in today´s turmoil and avoid being carried away by the crowd in making macro bets in traditional 60/40 assets. Private assets stand to harvest illiquidity premia in the order of 4% to 6% on top of their beta driven market returns.3 The more likely these traditional 60/40 returns are to be negative, the more valuable today’s generous illiquidity premia will prove to be.

- Mohamed A. El.Erian: https://www.mohamedel-erian.com/

- The terms “liquidity premium” and “illiquidity premium” are used interchangeably in the financial literature. It is the same concept and has the same meaning.

- Mark Anson. “Measuring Liquidity Premiums for Illiquid Asset”.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.