Private Equity Performance Across the Cycle

In our June 2022 newsletter, we took a look at the multiyear deployment pace of private equity funds. As just 40% of the capital is deployed over the first three years, we encouraged investors to devise a sound and realistic long-term investment strategy.

We now focus on the performance of vintages across the cycle. Specifically, we look at the high-growth and low-inflation period of 2009-2018 and at the pre–Global Financial Crisis (GFC) years. These two periods contain valuable insights for our investment strategy going forward.

We find empirical evidence that investing through new commitments when the going gets tough and panic is highest, as in the post GFC years, delivers the strongest investment results.

In addition, global equity markets1 have declined 25% so far this year. The yields to maturity of sovereign issuers2 have shot up by about 2.5% and those of junk bonds have doubled.

Still, we must maintain the course with our private asset investment strategy. On the one hand, as we saw in our previous note, capital will be deployed gradually over the next six years. On the other hand, investment performance is strongest just after the darkest hours.

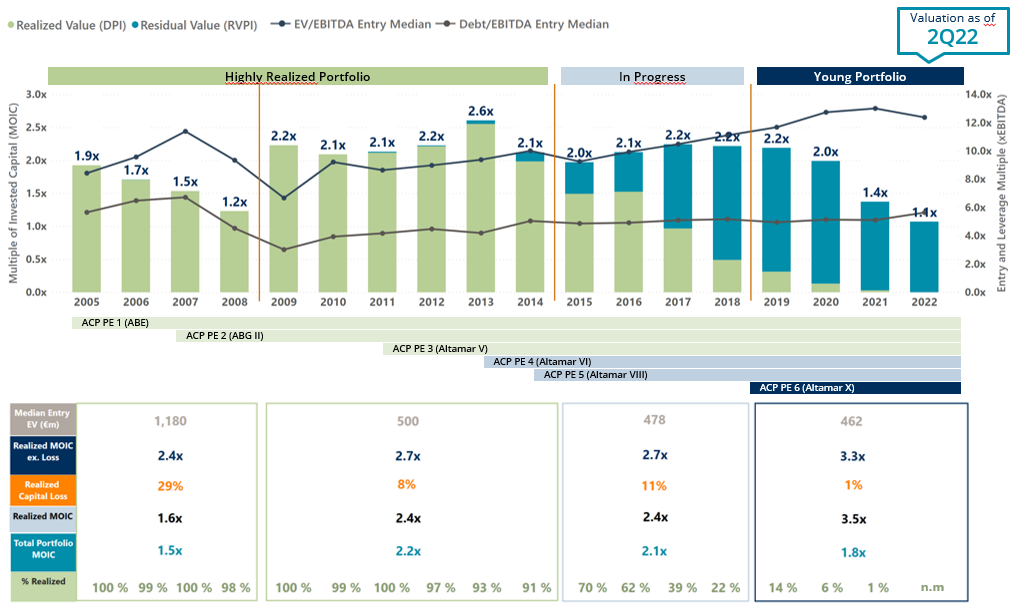

Valuation as of June 30th, 2022. North American and European companies in Altamar’s Primary Buyout Funds – primary deals only. Excludes companies in the Debt sector. The sample contains 4010 companies as of 30/06/2022.

MOIC, DPI, RVPI and Realized Capital Loss weighted by invested cost. Buyout multiple (EV/EBITDA), Debt multiple (Net Debt/EBITDA), both entry metrics and median values. Realized Capital Loss calculated as realized loss over total realized cost. 2019-22 Realized capital loss not meaningful (n.m.) given low divestment volume during the period.

Figures refer to the mature Altamar Private Equity, S.G.I.I.C., S.A.U. Commingled funds: ABE, ABG, Altamar V, Altamar VIII & Altamar X.

During the years preceding the GFC, both entry (EV/EBITDA) and leverage (Debt/EBITDA) multiples keep increasing and reached historically high levels. As the crisis hit portfolio companies, portfolio losses reached a staggering 29%. Still, funds3 managed to deliver a multiple on invested capital (MOIC) of 1.5x.

We can appreciate that both entry and leverage multiples settled at lower levels in the aftermath of the GFC. As economies recovered, portfolio losses declined to 8% and exit valuations reached multiples of 2.4x. As a result, private equity funds were able to deliver a MOIC of 2.2x. Capital gains increased by 140% from 0.5x capital gain in the pre-GFC period to 1.2x capital gain thereafter.

Vintages for the period 2015-2018 have been able to continue delivering strong multiples of 2.1x despite the impact of the COVID pandemia starting in early 2020. Exit multiples have averaged 2.4x and portfolio losses 11%.

Looking Forward

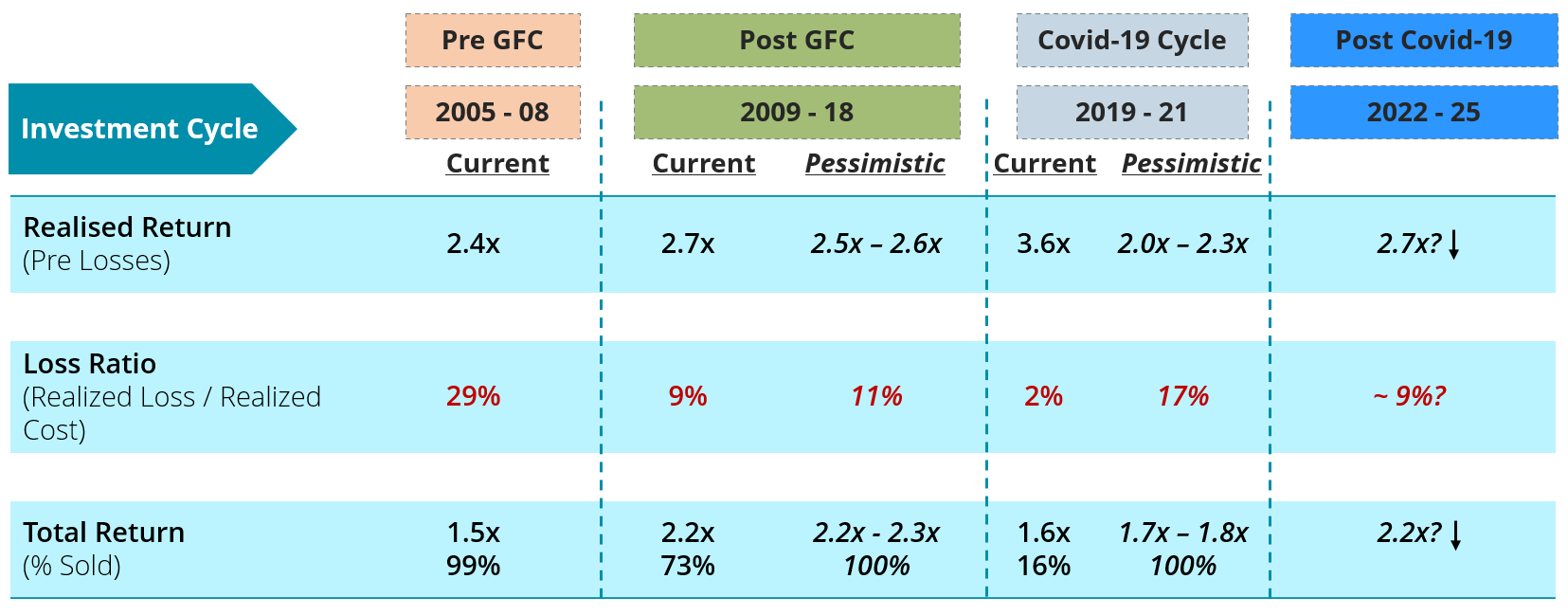

What performance can private equity funds expect for the most recent vintages of 2019 to 2021?

On the one hand, entry multiples have again reached record highs as has also been the case with valuations across all major asset classes. On the other hand, leverage is lower than that reached in the pre-GFC years. In addition, interest rates were at rock bottom and covenants were light.

All in, in the context of a worsening macroeconomic environment, we can expect returns lower than in the recent growth years but higher than those delivered in the pre-GFC years. Considering that losses could reach 15 to 20%, we could see MOICs of 1.7x to 1.8x:

“Realised return” corresponds to realized investments excluding written-down investments. “Total return” corresponds to both realized and non-realised investments, including written-down investments.

- S&P500 performance to 26th September, 2022.

- 10y Treasury bond performance to 26th September, 2022

- Figures refer to the mature Altamar Private Equity, S.G.I.I.C., S.A.U. Commingled funds: ABE, ABG, Altamar V, Altamar VIII & Altamar X.

- For further information, see “Targeting Private Assets”, page 42.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.