Capturing the Mid-Market Opportunity

Private equity is the main way for investors to systematically achieve diversified access to the large middle market segment and its significant potential. Just a small fraction of these companies is quoted in public markets.

Private equity managers are able to unlock the extraordinary potential of these companies with a unique toolkit of value creation levers. Nevertheless, to capture this opportunity, manager selection and diversification are key to avoid the risks of high dispersion of returns.

The mid-market is the backbone of the corporate world in Europe and North America. Many of these mid-market businesses have market leading positions globally in their specific niches.

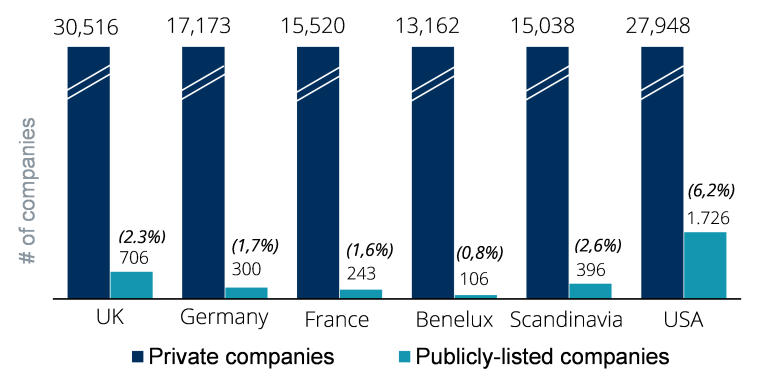

However, investors can access only a small fraction of them through the public markets. The universe of privately owned companies is considerably larger than the one of publicly listed companies:

Privately Held vs. Listed Companies in the Mid-market1

Private equity is therefore the main way for investors to systematically gain diversified access to the mid-market and the growth and value-creation potential of its companies. Private mid-market corporates enjoy advantages that are hard to maintain under public ownership. The intense scrutiny and pressure to beat quarterly earnings expectations, for example, undermines the management style that makes the mid-market so successful. The unique emphasis of private equity on long-term value creation within a clear business plan and a strict time frame is ideally suited to develop mid-market companies to their full potential. While these features represent structural advantages of private equity over public markets and are common to the asset class irrespective of size, they are regularly important drivers of value creation in the mid-market, the main ones being:

- Information advantage – Private equity managers have access to all relevant and material information of the target company. They would always proactively engage with management before making an investment decision. As a result, GPs can identify and address the specific risks and opportunities associated upfront and develop a post-acquisition value-creation strategy.

- Negotiated purchase price – Mid-market GPs are often able to source proprietary deal flow or convert competitive processes into exclusive negotiations with the seller. In these situations, factors besides valuation will drive the decision making of the seller, like understanding his motivation, the speed and certainty of closing a transaction, and the ability of the buyer to unlock the future potential of the business while protecting the legacy of the founders in the community.

- Innovation potential – In a world adapting to deglobalization and demographic changes, growth and productivity gains increasingly rely on innovation, which largely takes place outside of public market. Mid-market companies driving this innovation have the potential to generate higher growth rates and outsized returns for investors.

- Management influence – Private equity funds typically acquire either majority stakes, or significant minority stakes with strong protection rights, which allows them to steer corporate strategy and execution. Top managers use this control to effect change, transform good companies into better ones, and help build the infrastructure for scaling up the business. The value generating toolkit may include developing and strengthening the management team, developing key performance and risk indicators and appropriate incentives, supporting organic growth initiatives (including the internationalization of a business), driving M&A strategies with capital and expertise, and addressing operational improvement potential with in-house functional expertise and external advisors.

- Alignment of interest – Strong alignment of interests allow mid-market businesses to attract better talent. Private equity managers provide incentives to both their own team members and the management teams. Managers of portfolio companies will typically have “skin in the game” and participate in the success of the investment through “sweet equity” or stock options. Where private equity is the solution to a succession issue in a family-owned mid-market company, these incentive mechanisms are powerful tools for strengthening the alignment of the new leadership team managing this transition.

- Long-term focus – Private equity sponsored businesses are typically below the radar of buy-side analysts and do not have the same disclosure requirements as their public counterparts. This privacy allows shareholders and management to stay committed to their long-term value creation plans instead of managing quarterly earnings and to focus board room discussions on strategy rather than tactics on how to beat analyst expectations.

While the asset class has consistently delivered a return premium2 over public markets, lower mid-market funds have the potential to deliver outsized returns as long as the right selection is made. Potentially higher returns of lower mid-market funds bring the risk of a higher dispersion, though.

The dispersion of returns is significantly higher than in the upper segments of the private equity business as smaller companies tend to be more vulnerable to down cycles and have smaller teams. This is why manager selection and diversification are critical.

Outperformance of Lower Mid-Market funds, with a higher dispersion of returns3

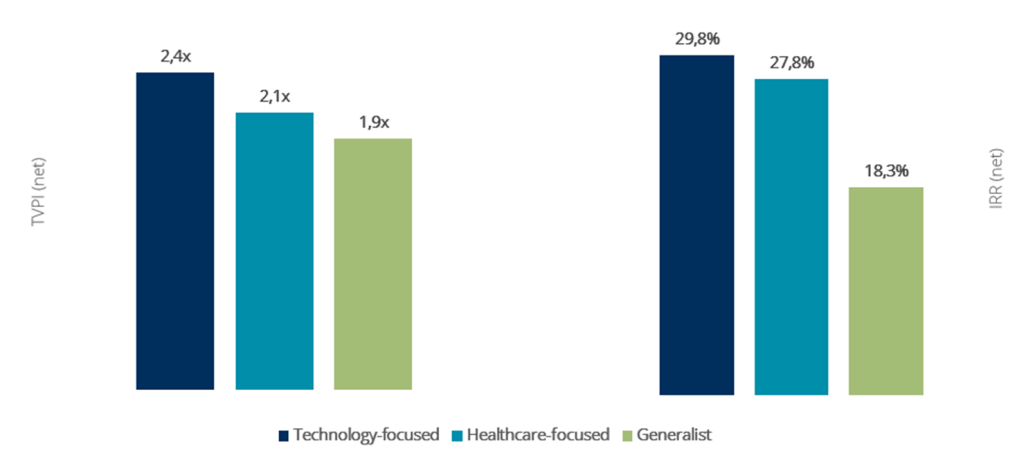

Sector-focused funds that invest in industries that enjoy long-term tailwinds tend to perform strongly. For example, the technology and healthcare sectors have experienced a great period over the last 10 years compared to the other sectors. However, again, selection is key, as some sectors can suffer over the long run leading to poor returns (oil and gas, consumer, etc.).

Outperformance of Sector-focused Funds4

Unlike large private equity funds with a multi-sector approach, generalist GPs in the mid-market will not always have sufficient resources to support a team of true specialists across every sector. Accordingly, sector focus can provide a real competitive advantage in the mid-market, where sector expertise matters. Expertise matters at entry, where a sector specialist is often better equipped to assess the risks and opportunities of a business and is a more credible counterparty when talking to the management team; over the life of the investment, with more relevant experience and networks to add value; and at exit, with deeper insights into the strategic agenda of potential buyers.

While sector expertise can make a difference, flexibility across multiple subsectors and geographies may prove critical, though, in times of fundamental shifts in the macro environment. Generalist and sector-focused funds in the mid-market can be an attractive complement to a broader “core” private equity portfolio, if carefully selected. Investing successfully in the mid-market and generating attractive risk-adjusted returns5 requires rigorous selection, diversification, and access (to generally highly demanded funds for the size they have).

- Thomson Reuters Eikon 2019. Companies with an enterprise value of €25m – €500m

- Figure 26. https://www.bain.com/insights/private-equity-outlook-global-private-equity-report-2023. Past performance is not necessarily indicative of future results, as current economic conditions are not comparable to past performance, which may not be repeated in the future.

- Preqin, Analysis of North American and European Buyout and Growth managers’ performance (vintages 2006-2018) as of August 2022. Lower Mid-Market funds defined as funds with a fund size below USD 2.5bn. “Non-Lower Mid-Market Funds” defined as funds with a fund size above USD 2.5bn. Past performance is not necessarily indicative of future results, as current economic conditions are not comparable to past performance, which may not be repeated in the future.

- Preqin, Analysis of North American and European Buyout and Growth managers weighted average performance (vintages 2006-2018) as of August 2022. Past performance is not necessarily indicative of future results, as current economic conditions are not comparable to past performance, which may not be repeated in the future.

- Past performance is not necessarily indicative of future results, as current economic conditions are not comparable to past performance, which may not be repeated in the future.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.