AltamarCAM’s Views on the Impact of Tariffs in Private Equity

Following the aftermath of Covid-19, the war in Ukraine, and interest rate hikes triggered by high inflation, we are now facing a new macroeconomic uncertainty: the imposition of tariffs by the U.S. to many countries and the potential impact this could have on global economic activity.

Given the fast-moving nature of this policy environment, making accurate forecasts is particularly difficult. However, we want to share our perspective on the possible implications for our portfolio companies and private assets’ markets in general.

What has happened?

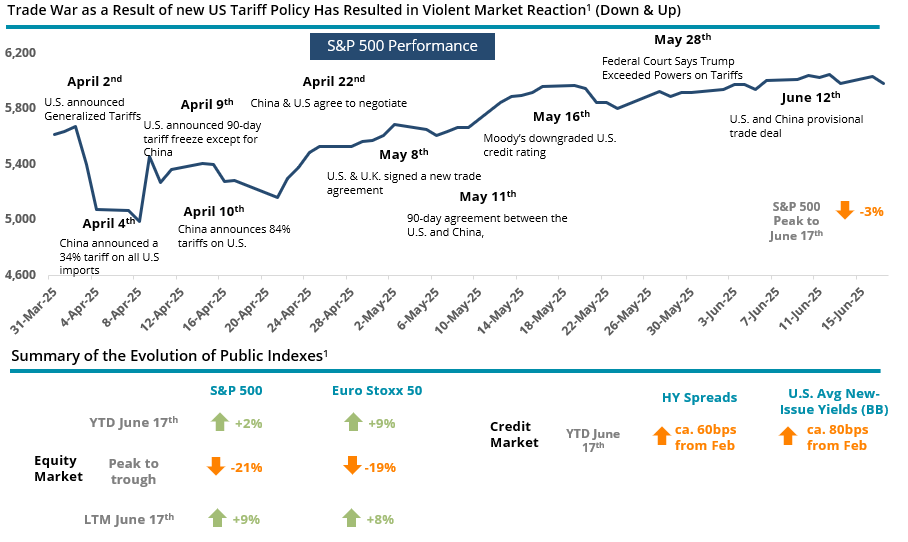

As widely reported, on April 2nd (Liberation Day), the Trump administration announced its new tariff policy. This sparked a strong reaction in main public equity indices falling nearly 20% from their 2025 all-time highs.

Debt markets were not spared either. Bond spreads widened—particularly in higher-risk segments such as high yield—and government bond yields also rose in response to the heightened uncertainty. However, this has not had a noticeable impact on the availability of debt to finance operations in the private markets.

Summary of the Evolution of Public Indexes

As it can be observed in the chart, following an initially sharp negative impact on the markets, the Trump administration has since softened its rhetoric in the weeks that followed. This includes the 90-day extension announced on April 9th, along with a series of agreements that have since been reached. As a result, equity markets have experienced a notable rebound and credit spreads improved, while access to financing has remained the norm.

How does this affect Private Assets, and Private Equity in particular? We can summarize the potential direct impact across three broad dimensions: transaction activity, portfolio companies’ operational performance and valuations.

- Impact on Transaction Activity

- On the negative side, macro uncertainty typically derives in a more cautious approach from buyers and tends to delay exit processes, as sellers seek to optimize their returns. Therefore, a decline in distribution and investment activity is not strange during uncertain times. As a result, this could potentially lead to a slowdown in fundraising, as some LPs look for liquidity to be able to continue with their commitment programs.

- On the positive side, private asset investors have demonstrated in the past their ability to stay ahead of new investment opportunities that could emerge in volatile environments (for direct investment firms, as well as for co-investment and secondary players).

- It remains unclear how the situation will affect the cost and availability of debt to finance transactions, as it will depend on interest rates evolution. For the time being, debt has generally remained available.

- Impact on Portfolio Companies’ Operational Performance

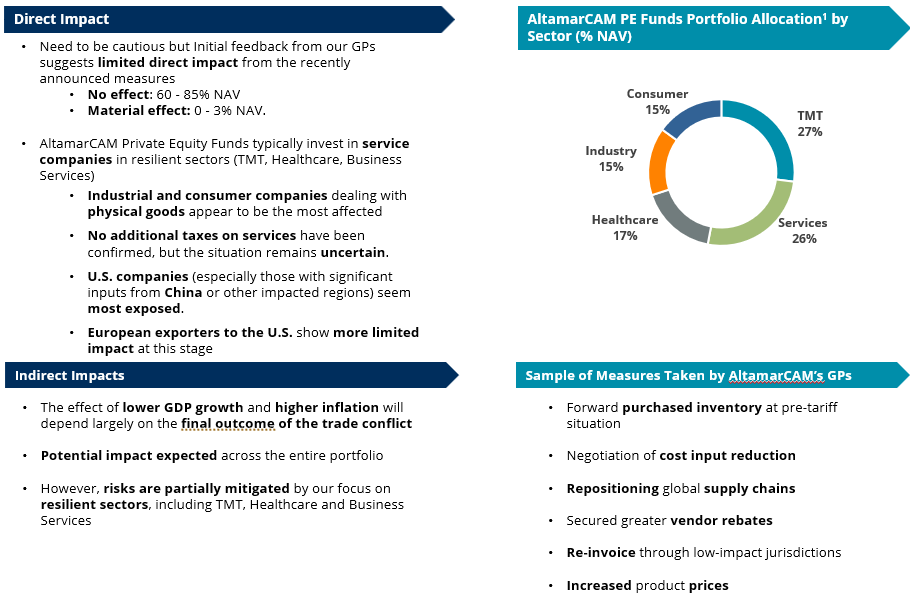

- Direct Effects: Based on insights from our GPs, direct exposure is limited. Our private equity portfolios are concentrated in resilient sectors such as technology and software, healthcare, and business services —industries that are less sensitive to international trade dynamics and not part of the initial focus of the tariff policy. The feedback is consistent with available market surveys as well as our own data. In summary:

- No impact: approximately 60–85% of NAV

- Material impact: around 0–3% of NAV

- Indirect Effects: These are harder to quantify due to the high degree of uncertainty. The key factor will be how the final tariff structure is defined and its implications for economic growth (likely negative) and inflation (potentially moving upwards). If a recession hits, then portfolios could have a general impact on revenues and margins.

- Direct Effects: Based on insights from our GPs, direct exposure is limited. Our private equity portfolios are concentrated in resilient sectors such as technology and software, healthcare, and business services —industries that are less sensitive to international trade dynamics and not part of the initial focus of the tariff policy. The feedback is consistent with available market surveys as well as our own data. In summary:

In response, most of the firms have already taken steps to mitigate potential negative effects on their portfolio companies. These include:

- Establishing dedicated teams to monitor the situation per company on a constant frequency basis and sharing insights between portfolio companies, with central coordinators.

- Supply related measures such as:

- Forward purchased inventory at pre-tariffs situation.

- Negotiation of cost input reductions.

- Re-invoicing through low-impact jurisdictions.

- Repositioning / re-shoring global supply chains, which take some time (months or more than a year).

- Revenue-related measures such as:

- Inflation pass-through by increasing product prices.

- Buy and build, taking advantage of competitors that might suffer difficulties.

- In parallel, it has been a common practice to establish contingency plans with management and boards, to be prepared in case a recession hits. This could include cost control measures and tighter cash flow preservation.

Impact on Operating Performance of Private Equity Portfolios

- Impact on Company Valuations

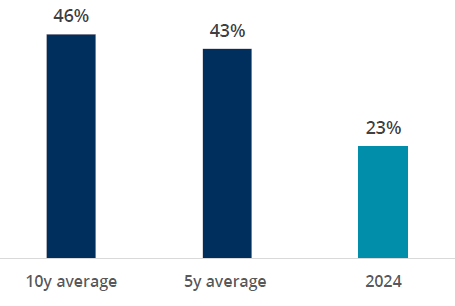

- On the positive side, valuations in private equity have historically been less volatile than public market ones. Additionally, private equity managers tend to value with a discount with respect to public markets and to final exit outcomes. As an example, over the past decade, AltamarCAM private equity buyout’s portfolio has achieved a 46% exit uplift over the valuation 12 months prior to exit for those deals which have been fully realized investments. The time lag in terms of valuation reporting also smooths valuation evolution.

- On the negative side, lower growth expectations and a possible weakening US dollar may put downward pressure on portfolio company performance and returns on USD-denominated assets.

- Uncertainty remains with respect to future movements of interest rates, which will continue to be a critical driver of valuations.

Exit Uplift vs One Year Prior Valuation (Avg by Exit Year)

Conclusion

Macro uncertainty persists, as has been the case since covid-19 outbreak. Direct impact from tariffs in their portfolios is perceived as limited by investment firms. However, second and third order effects remain unpredictable. However, we believe that private markets have different elements that make them effectively defend their portfolios, as has happened in prior difficult cycles, mainly:

- Portfolio diversification across companies, sectors, regions, vintages, transaction types, and strategies

- Flexible active ownership model

- Due diligence based on fundamentals, selecting long-term secular growth themes

- Long-term approach, including exposure across different cycles and flexibility to exit and investing at the right time

- Valuation based on fundamentals, with lower volatility when compared to the one in public markets

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.