A Bright Spot On The Horizon

With a challenging backdrop of geopolitical instability, rising inflation, and public market volatility, 2022 has proven to be a difficult environment for private markets investing. However, there is a bright spot on the horizon, as a confluence of factors is expected to provide favorable conditions for private equity secondaries.

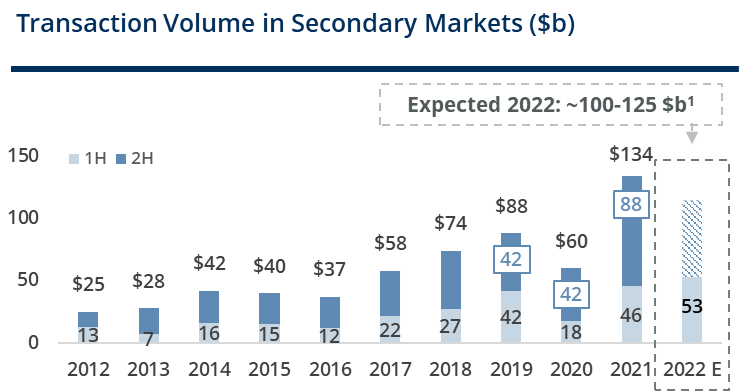

The post COVID-19 environment has been anything but steady for secondaries. After a roaring 2019, expectations were sky-high for another huge year of secondary transaction volume in 2020. Instead, the onset of the COVID-19 pandemic put the secondary market in a holding pattern for the first half of the year. Volume, however, did eventually return in the second half of 2020, and set the stage for a massive surge of deal flow that would lead to a record in 2021, reaching $134bn.

Source: Greenhill & Co. August 2022- “Global Secondary Market Review”.

Expected Volume 2022. Source: Evercore Private Capital Advisory H1 2022 Secondary Market

Initial expectations heading into 2022 were equally strong with estimates that it could even exceed 2021, but a rising risk climate and increased market volatility created a divergence in buyer and seller expectations, widening the bid-ask spread for most secondary transactions and cooling the market. The latest published expectations suggest that, despite market uncertainty, the secondary market might still achieve a volume of between $100-125bn in 2022. Still, current market feedback suggests the outcome will likely land at the lower end of that range.

As we evaluate the opportunity ahead for secondaries, there are two key drivers of this slowdown worthy of consideration. First, as market risk has materially increased during 2022, the natural expectation among market participants has been that private asset valuations would eventually fall in line with the steep declines witnessed in public markets. However, this correction has yet to materialize. Many sponsors report that while they have accounted for the valuation declines in comparable company sets, or “comps”, against which their own valuations are measured, the fundamentals across their portfolios have remained strong, thus offsetting any potential for a significant overall drop in valuations. This has led to a widening of the bid-ask spread as we head towards a more challenging 2023 for portfolio companies.

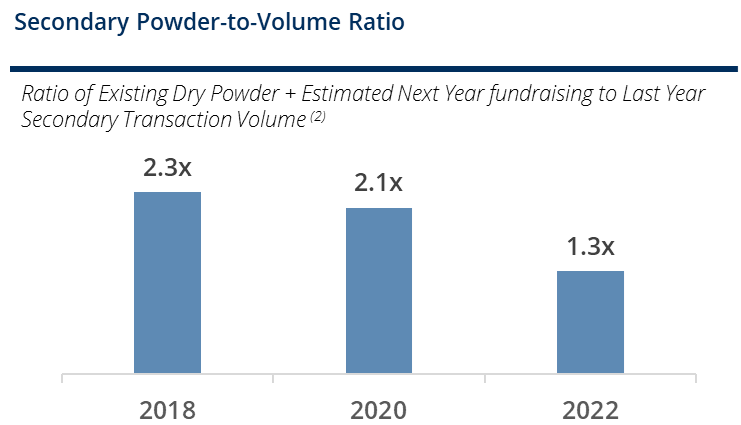

The second consideration for this slowdown is the clear imbalance of capital availability relative to transaction volume in the secondary market. In 2021 buyers deployed record amounts of capital, far surpassing the pace of fundraising, and have yet to fully reload their dry powder. Estimates today point to the ratio of buyside dry powder to secondary transaction volume, a proxy for market competitiveness, below 1.5 times, a near decade low.

Source: Evercore 2021 YE Survey and 2022 H1 Survey Results Report.

The result of the combination of these two factors—a market with disparate views on valuation and a capital constraint driving a buyer’s market—has led buyers to be highly selective.

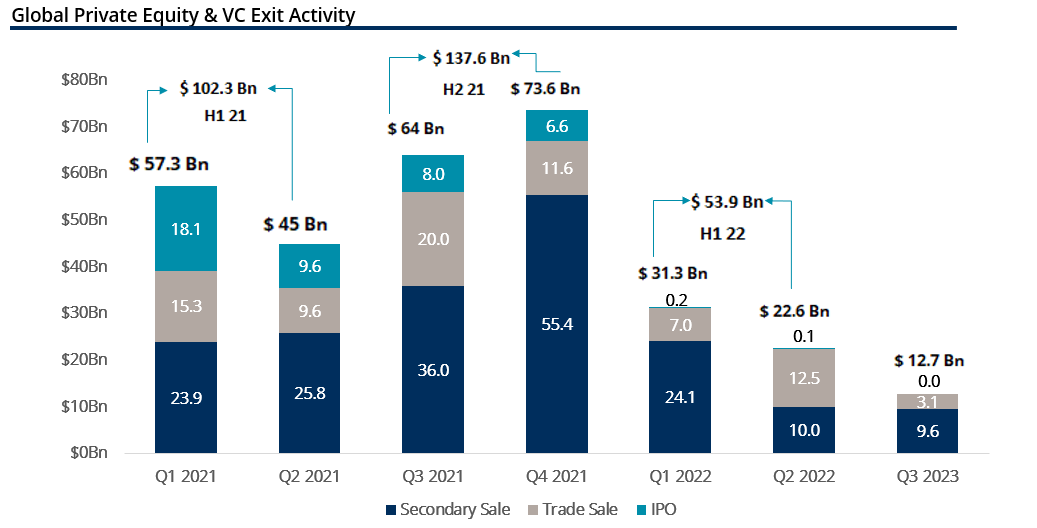

At the same time, private markets liquidity has clearly dried up with the pace of distributions slowing quarter by quarter throughout 2022 in response to deteriorating market conditions. As such, it is expected that selling interest will remain strong as market participants with near-term liquidity needs will eventually turn to the secondary market for a solution. We are already beginning to see this trend taking hold late in 2022 but expect it to accelerate meaningfully in 2023.

Source: S&P Global market intelligence

We also expect that a similar trend will be evident in the GP-led segment of the secondary market where GPs may elect to continue to own trophy assets via continuation vehicles instead of selling them outright to other sponsors when market conditions are unlikely to yield top pricing. Given our expertise in GP-led transactions, we believe this will be an attractive opportunity.

For secondary buyers, this means conditions are aligned for an attractive deployment opportunity. The combination of seller driven needs and limited capital should allow buyers to maintain selectivity, while at the same time, pricing in discounts to account for both valuation asymmetries and increased market risk. Our view, however, is the best returns in this environment won’t be achieved by simply buying a slice of the market in hopes of broadly capitalizing on the opportunity. Instead, savvy buyers will maintain their selectivity, targeting high quality sponsors and resilient assets that can comfortably weather a downturn, while at the same time -and equally as importantly- avoiding less desirable assets.

1 y 2 Source: Evercore 2021 YE Survey and 2022 1H Survey Results report.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.