Private debt in rising inflation and interest rate cycles

Across most developed and emerging economies, inflation has surged well above central bank targets. In the last twelve months to May, consumer prices rose to 8.6%, 8.1% and 9.1% in the US, the EU and the UK[1]. There is a growing concern that inflation may become persistent, fuel inflationary expectations, and lead to higher wage pressures that could push up inflation higher and for a sustained period.

Markets have reacted to this situation by pushing up interest rates. During periods of rising interest rates, fixed income investors are at risk of losing money due to the impact that higher discount rates have on their portfolios. They often react to this environment by reducing the duration (interest rate sensitivity) of their portfolios via the derivatives market or by reallocating their portfolios into short term bonds or the money markets. Private debt can help investors navigate a rising rate environment due to its floating coupon and the senior position on the capital structure of direct lending strategies.

Private debt offers investors an alternative to adapt their portfolios to a rising price and interest rate cycle given the floating rate nature of the loans underwritten by direct lenders. A floating coupon implies a duration lower than a comparable fixed coupon bond and thus, ceteris paribus, private loans to corporations can perform better than the typical fixed coupon bond when rates go up.

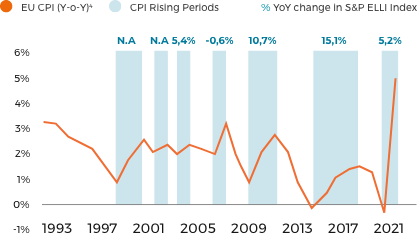

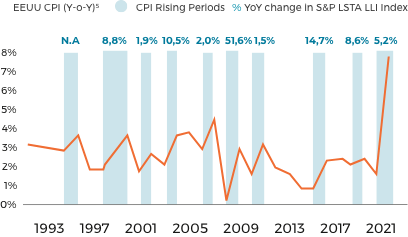

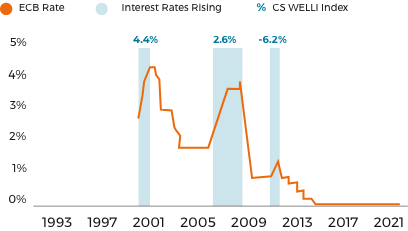

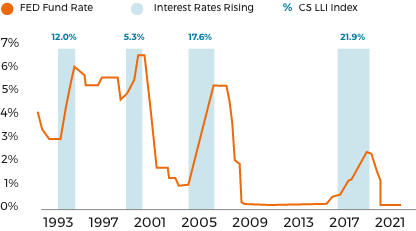

The following charts show how senior loans perform in scenarios where inflation and central bank rates increase. Given the scarcity of return performance data[2] for private debt, we use as a proxy to private loans the returns of senior loans, which have a similar structure and duration. The blue shaded areas present the returns of senior loan indices during times of accelerating inflation or rising interest rates.

Return generated by senior loans [3] during periods of accelerating inflation in the Eurozone

Return generated by senior loans during periods of accelerating inflation in the USA

Source: S&P, Federal Reserve Bank of St. Louis

Note: Past performance is no guarantee of future returns.

- The Economist; www.ec.europa.eu; www.tradingeconomics.com.

- There is not equivalent index for private debt direct lending returns in the Eurozone but there is an index in the US, the Cliffwater direct lending index published quarterly and that provides equivalent supporting evidence with positive returns during accelerating US inflation.

- Senior loan returns are measure using the Credit Suisse Leverage Loan Index and the Credit Suisse Western European Leverage Loan Index.

- Consumer Price Index: Harmonized Prices: Total All Items for the Euro Area, Percent Change from Year Ago, Annual, Not Seasonally Adjusted.

- Consumer Price Index: All Items for the United States, Percent Change from Year Ago, Annual, Not Seasonally Adjusted.

Return generated by senior loans when ECB´s monetary policy rates rise

Return generated by senior loans when the FED’s monetary policy rates rise

Source: Credit Suisse, Federal Reserve Bank of St. Louis, European Central Bank

The performance of loans during periods of accelerating inflation or rising central bank rates has usually been positive. Senior loans have indeed been among the best performing asset classes in 2022. Moreover, the Cliffwater Corporate Direct Lending Index exhibited a return to end of May 2022 of 2,4%, while almost every other fixed income asset has experienced losses in the same period. Nevertheless, if the rise in interest rates triggers a recession or an expectation of one, then the credit component of the return could negatively impact the performance of these loan investments.

What can we take away from this analysis?

- Due to the floating rate feature of private debt loans, this asset class is likely to perform better than other fixed income assets in periods when interest rates and inflation go up.

- This structural characteristic of private corporate loans helps explain why correlation with other fixed income assets tends to be low and thus, why adding direct lending funds to a fixed income portfolio can reduce the standard deviation of its performance.

- If the increase in central bank rates leads to a recession, the loan performance can suffer because of the credit risk component of its pricing. However, as direct lending sits at the top of the capital structure, investors are more protected against severe outcomes.

- Finally, on rising rate environments, refinancing options could be more limited and will be more expensive. This strengthens the importance of leverage discipline to mitigate restructurings. Conversely, one could hedge the risk of impairments by investing in stressed and distressed strategies. We will review these strategies in an upcoming newsletter.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.