Galdana's take on AI

Artificial Intelligence (AI) represents another paradigm shift that will also have a major impact in shaping our society from here onwards. It is a transversal theme with a deep impact beyond the technology sector itself. It will transform how we work and play, will boost productivity across the whole economy and will bring its own fair share of risks that need to be proactively tackled.

The benefits for vehicles advised by Galdana Ventures, S.L. and their investors may come from investing in the GPs that have successfully deployed money in previous “paradigm shifts”. Benefits will also accrue to AltamarCAM and our clients from the increase in productivity that AI will bring to AltamarCAM. We are firmly committed to embracing this technology.

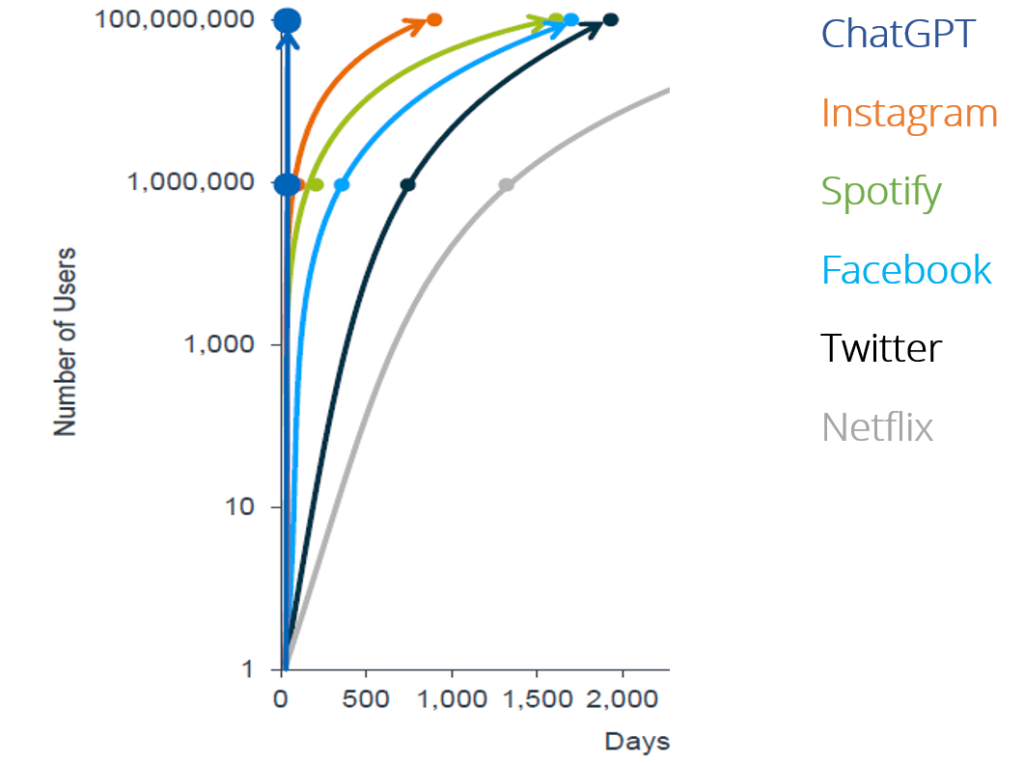

Industry players have been developing and training algorithms/LLMs (Large Language Models) for at least 10 years. As AI depends on inputs and outputs, the public launch of ChatGPT to the world, in November 2022, has been the key inflection point for this technology to achieve “mass adoption”.

Since then, the speed in the adoption of Generative AI (Intro to GenAI), the most dynamic subsector of AI, is vertiginous. Actually, this article may itself become obsolete very quickly as new companies continuously and quickly emerge.

Number of Days to 1M and 100M Users by Technology

Source: https://www.theguardian.com/technology/2023/feb/02/chatgpt-100-million-users-open-ai-fastest-growing-app

The launch of ChatGPT by Open AI has been a “Tesla Moment” for the Generative AI industry. The major tech companies, as it also happened with the car companies in the Electronic Vehicle space, have been forced to disclose their progress on Generative AI, as they did not want to be seen falling behind ChatGPT.

Generative AI represents the kind of paradigm shift that happens once in a decade, as happened with the “Netscape Moment” (1990’s), the “iPhone Moment” (2000’s) and the “Cloud Moment” (2010’s). In our opinion, Venture Capital Firms that have successfully navigated through these paradigm shifts in the past are more likely to benefit from the current Generative AI paradigm shift we are witnessing.

What will the AI ecosystem look like?

In our view, AI should not be considered as a sector itself, but rather a transversal theme that provides opportunities, and threats, to virtually every company in the world. We can appreciate two differentiated sets of opportunities:

- Existing tech and non-tech companies: AI has the potential to increase efficiency across all business sectors. Unlike the shift in cloud computing, which disrupted many well-established companies, we do not believe AI will be a company disrupting technology, but an efficiency booster due to its easy-to-use nature.

- New Generative AI Native companies: Generative AI technology will also be an enabler of new markets created from scratch without incumbents. This category of Generative AI Native companies represents the largest bucket of potential opportunities for VC investments.

The value creation of this Generative AI platform shift will be in the US$ trillions level. Consumers will end up as its main beneficiaries. In addition, we expect AI to evolve as an “open-source” technology that will create a fertile ground for a vibrant ecosystem in the AI space, reducing the costs of starting new companies based on AI even more.

In a world of open-sourced AI, as has happened with previous waves of creative disruption in technology, the winners will be those able to innovate in terms of business models with good product-market fit rather than the ones with the deeper knowledge of AI.

Which will be the impact of AI in our economy?

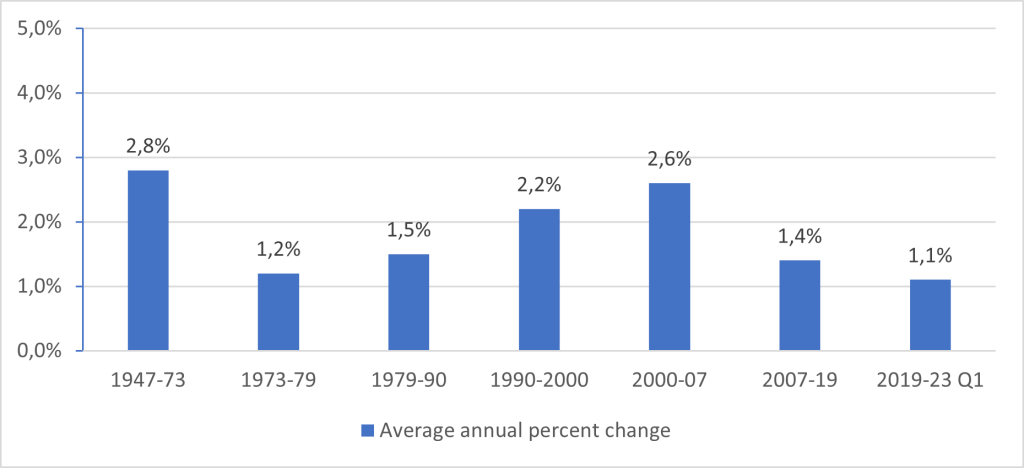

The impact of AI in the next decades will clearly go beyond the technology sector and impact our whole society and, more specifically, our economy. Although technology was one of the main drivers behind the increase in productivity, in the period from 1990 to 2005, on the back of the “Internet paradigm” shift, productivity has stalled since 2005 as the “iPhone paradigm” shift delivered a huge consumer surplus, but no meaningful increase in productivity for the economy as a whole.

In the context of the new Generative AI paradigm shift, we believe that once the AI learning curve has been surpassed, AI should increase productivity in our economies in the next 15 years in the same way it happened with the Internet in the period from 1990 to 2005 period.

Productivity change in the nonfarm business sector (1947-2023)

Source: US Bureau of Labour Statistics (06/01/2023). Measures of labour productivity compare the growth in output to the growth in hours worked and measures of total factor productivity (TFP), also known as multifactor productivity (MFP), compare growth in output to the growth in a combination of inputs that include labor, capital, energy, materials, and purchased services.

To continue developing successfully, the AI sector needs to address several challenges that will define its future:

- Development of a regulatory framework around AI is essential and required by the different stakeholders playing in the sector. The new regulatory framework will determine the AI ecosystem going forward.

- Although it is likely that bad actors will inevitably improve their capabilities in the next few years, it is critical that the ethical deployment of AI advances faster, so that AI will consolidate itself as a force for good.

Where are we in the hype cycle?

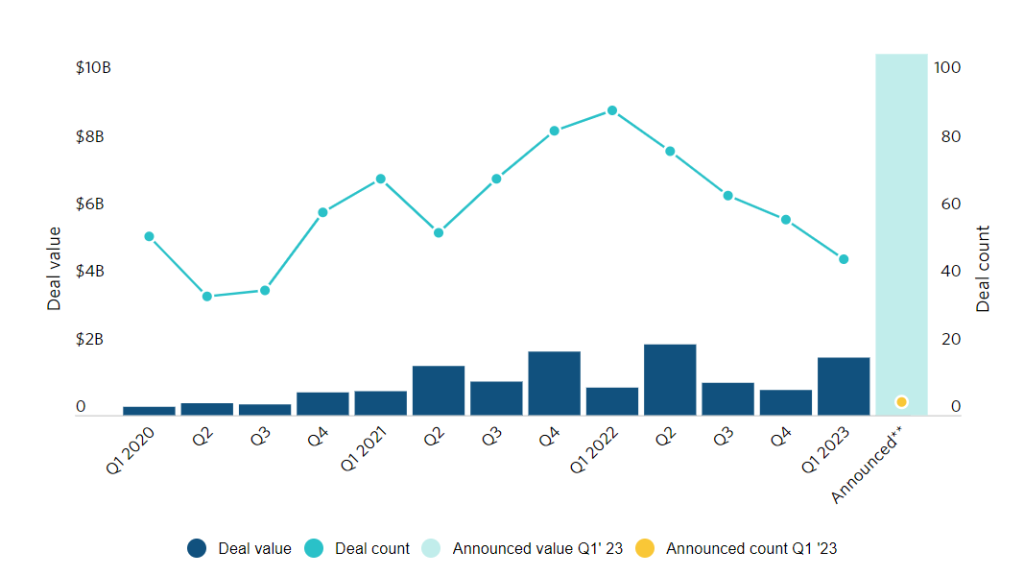

In terms of the market environment in the Generative AI sector, despite the inflection point reached in the last year, we see no signs of overheating in the sector yet, with investment activity to date averaging around the levels of the last 2 years.

VC deals for generative AI

Source: PitchBook data (global, as of 1-Apr-23. Includes Microsoft $10m investment in OpenAI)

As of May 2023, there are 13 VC-backed Generative AI unicorns, and consistent with the original investment thesis of Galdana Ventures, S.L., we are indirectly invested in 9 of them. Despite being very recent investments, the indirect exposure of the funds advised by Galdana Ventures, S.L., to these companies is €2.8m with an aggregate MOIC of 2.0x1.

Generative AI startups with +$1bn valuation

Source: CB Insights (as of 8-May-2023)

As AI is a rapidly evolving sector that will probably reshape the world where we live in the next 10 to 20 years, AltamarCAM is fully committed to staying in the forefront of this revolution to reap the benefits it will bring to those early adopters.

- Past performance is not necessarily indicative of future results, as current economic conditions are not comparable to past performance, which may not be repeated in the future.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.