Coping with the cycle through vintage diversification

Markets may endure volatility and severe corrections over the next few years. This will represent a challenge for existing mature funds planning to exit their investments and a great opportunity for new funds.

New funds deploying cash over the next few years through multi-year investment programs will be able to seize unique investment opportunities and harvest outsized illiquidity and complexity premia.

Valuation and yield-based expected returns of traditional 60/40 portfolios have collapsed. There is compelling evidence that there is no alternative to diversifying into liquid alternative strategies and private assets. However, investors are reluctant to deploy capital in these uncertain times.

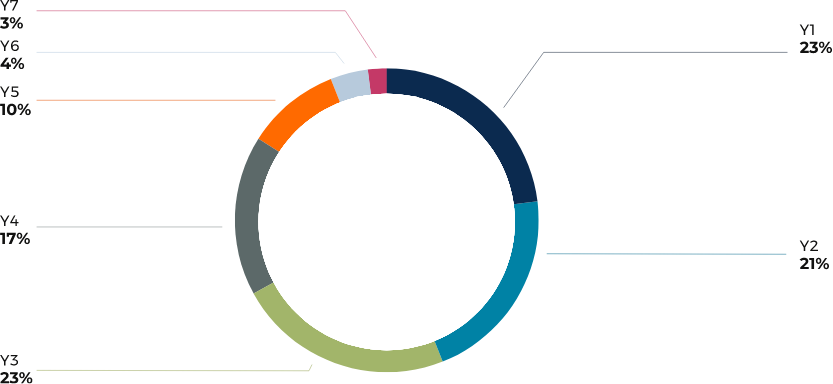

Direct single private equity funds do their best to get money working as fast as possible. Since inception, AltamarCAM has invested in 136 single funds. The median manager has deployed in the first two years almost 50% of capital actually invested[1]. These funds reached a 93% deployment rate at the end of year 5:

Year and Share of Investments – Direct Funds

Source: Based on all primary private equity comingled funds invested by Altamar Private Equity, S.G.I.I.C., S.A.U. since 2005.

1. Median percentage corresponding to 136 direct private equity funds in which Altamar Private Equity, S.G.I.I.C., S.A.U. has invested since 2005.

Without a proper vintage diversification strategy, investors risk investing a significant portion of their committed capital in the middle of a storm .

Fortunately, multi-year investment programs, such as those embedded in funds of funds and segregated managed accounts (SMAs), invest at a slower pace. It takes time for them to commit capital and even more time to deploy it.

As we can observe in the second pie chart, funds of funds have typically deployed just 19% of total invested capital over the first two years. It takes them up to 5 years to deploy 73%. Capital deployed thereafter represents a significant 27% of total invested capital.

Year and Share of Investments – Funds of Funds

Based on all primary private equity comingled funds invested by Altamar Private Equity, S.G.I.I.C., S.A.U. since 2005.

Note: Median percentage corresponding to 136 direct private equity funds in which Altamar Private Equity, S.G.I.I.C., S.A.U. has invested since 2005.

The deployment cycle is way far into the future, beyond the point we can accurately predict. If you overlay the deployment cycle with a proper commitment strategy, whatever happens to the markets over the next two to three years becomes immaterial. The only fear to consider is the fear of not following a properly thought-out investment strategy.

Don’t fear the markets. Fear not following a properly structured investment strategy.

Markets may endure volatility and severe corrections over the next few years. They will represent a challenge for existing mature funds planning to exit their investments and a great opportunity for new funds starting to deploy their cash.

New funds deploying cash over the next few years will be able to seize unique investment opportunities. Patient investors will be able to harvest outsized illiquidity and complexity premia.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.