Hedging Inflation Through Real Assets

The post COVID-19 global economic rebound and the Ukraine war have triggered a sharp increase in prices, wages, and energy costs that are pushing inflation rates back up to levels not seen for decades. We have been ushered into a new macroeconomic paradigm characterized by permanently higher inflation and interest rates.

Real assets generally perform well as a natural hedge in inflationary periods. These assets have intrinsic attributes embedded in them that are most helpful in rising inflationary regimes:

- This is not an investment recommendation, but just an opinion. Past performance is not indicative of future results.

Indexed Revenues

Revenues of real assets are typically based on contracts indexed to inflation. Companies can pass over to their customers and tenants their higher costs:

- For real estate assets with long-term leases indexed to inflation or sectors with shorter-duration leases, such as logistics or residential, owners have the capacity to regularly reset rents to market levels.

- Most infrastructure assets are operated under long term inflation-linked contracts. For example, in the operation of a public university with a “PPP” scheme, the asset owner gets an “availability payment” from the public administration every year that is indexed to inflation. Likewise, a motorway or toll road operator can adjust toll tariffs annually. Moreover, some specific assets such as energy-related ones are experiencing a multiplying effect in revenues due to the exponential increase of electricity prices.

Operating Leverage

Although revenues are indexed to inflation, operating costs may not fully reflect higher inflation rates. This mismatch brings valuable operating leverage benefits in rising inflationary periods.

Owners of real assets have the capacity to contain the impact of inflation on their cost base. Institutional real estate assets, for example, generally operate under triple net leases, by which expenses such as utilities, taxes, and insurance are borne by the tenant. In the case of infrastructure, most relevant costs derive from operations and maintenance, which are normally fixed throughout the life of the contract. Labor or energy costs can be passed through to the end users.

Brownfield vs. Greenfield Assets

Higher inflation rates may impact construction costs adversely. In some cases, these higher costs may not be passed on to the final customer and could potentially impact margins and the expected return of the project. Hence, existing assets (brownfield) are generally better protected than brand new projects (greenfield).

Financing Structures

Real assets are typically financed with either a fixed rate structure or with an interest rate hedge which partially protects investors from higher interest rates. In addition, infrastructure assets have long-term financing structures in place.

As assets currently in operation have a reduced risk profile, they can achieve improved financial terms with reduced refinancing risk.

Empirical Evidence

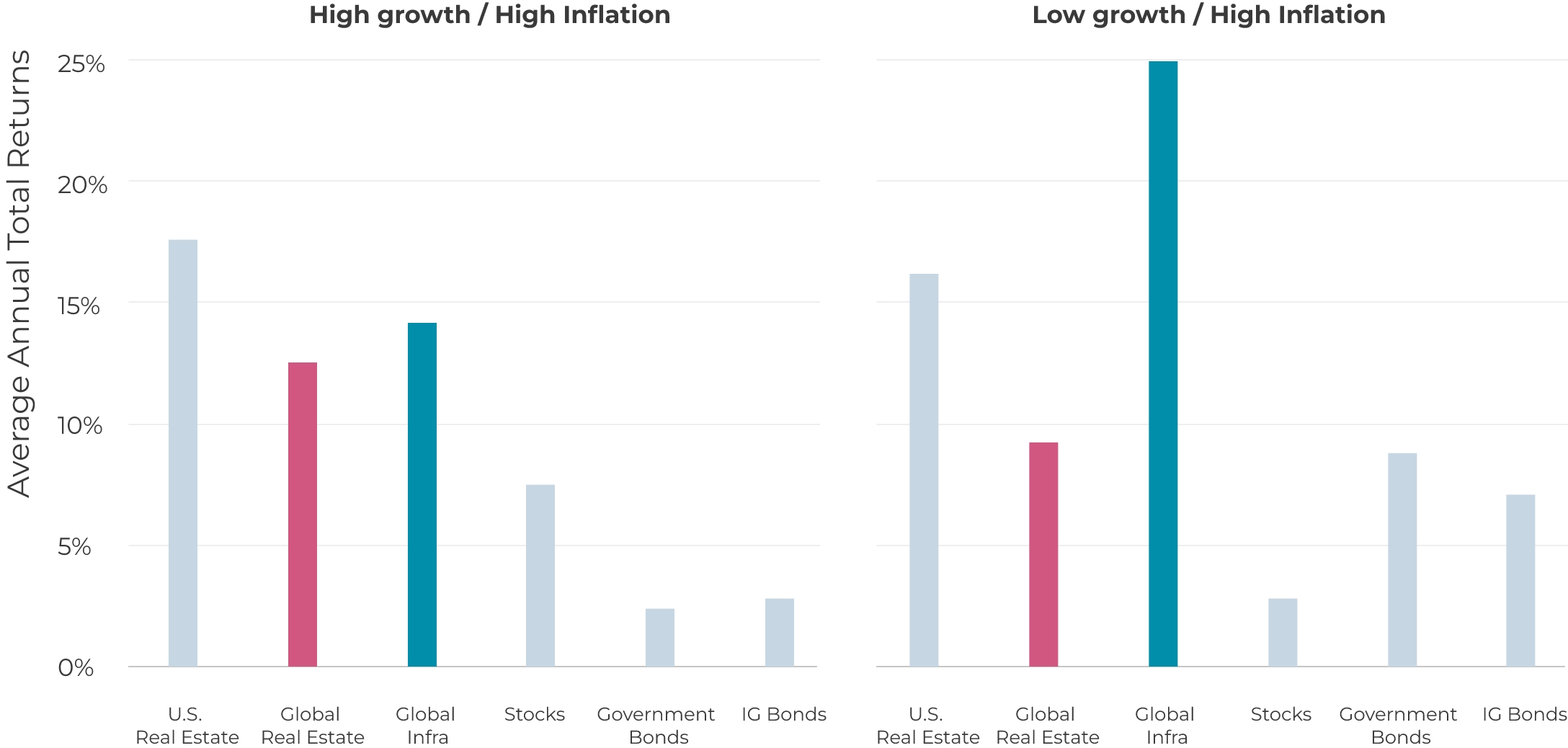

The combination of these factors makes real assets highly defensive and even outperform other asset classes during high inflation periods.

The charts below show average returns of different asset classes over the past 20 years, where both real estate and infrastructure outperformed traditional asset classes during high inflation periods both in high and low economic growth cycles:

Returns in inflationary periods

Source: Bloomberg, Barclays (Investment grade: US Agg Bond; Gov’t bonds: US Gov’t Agg TR), NCREIF (U.S. Real Estate: NPI), MSCI (Global Real Estate); EDHEC (Infrastructure: All equity) and S&P (Stocks: S&P 500); as of December 21, 2020 (annual data since 2001). Past performance is not indicative of future results. You cannot invest directly in an unmanaged index. High growth periods are when U.S. GDP > 2.5% and high inflation periods are when U.S. CPI > 2.5%

In summary, real assets perform well during high inflationary periods thanks to their inflation-indexed revenues, their ability to contain the impact of inflation on their cost base and, thus, benefit from operating leverage, and stable financing structures.

Considering the dispersion of performance for private asset managers, it is mission critical to invest along time-tested managers with robust asset management skills.

Staying invested

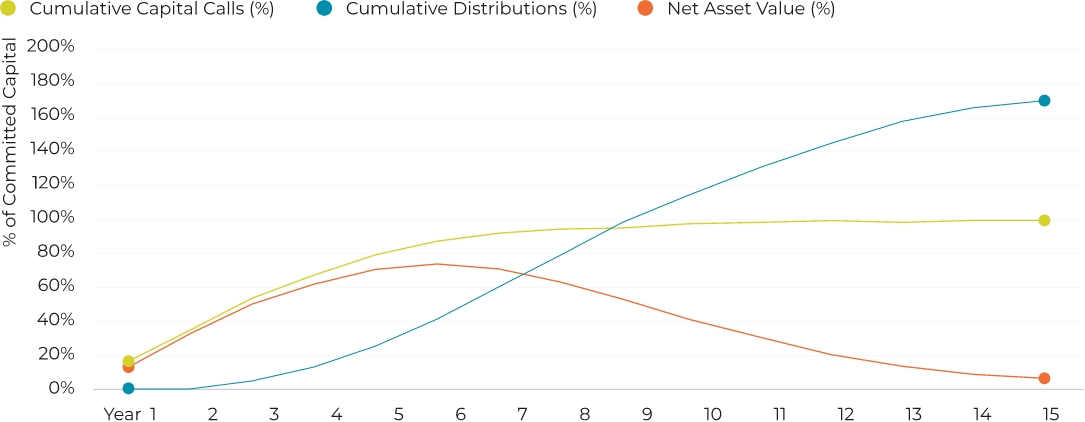

Private investment exposures are driven by commitments, actual drawdowns, and underlying fund performance. As investors just control the size and timing of their commitments, they need to carefully consider what commitment strategy best serves their strategic purposes and is best aligned with their risk profile.

- This represents a base case based on the experience of AltamarCAM Partners. It is not an investment recommendation, and past performance is no guarantee of future returns.

- Further details can be found in page 35 under “Commitment Strategies”.

The Single Buyout Fund

Source: AltamarCAM Partners based on Preqin data

3. Base scenario elaborated on the experience of AltamarCAM Partners. This may not be realised in the future.

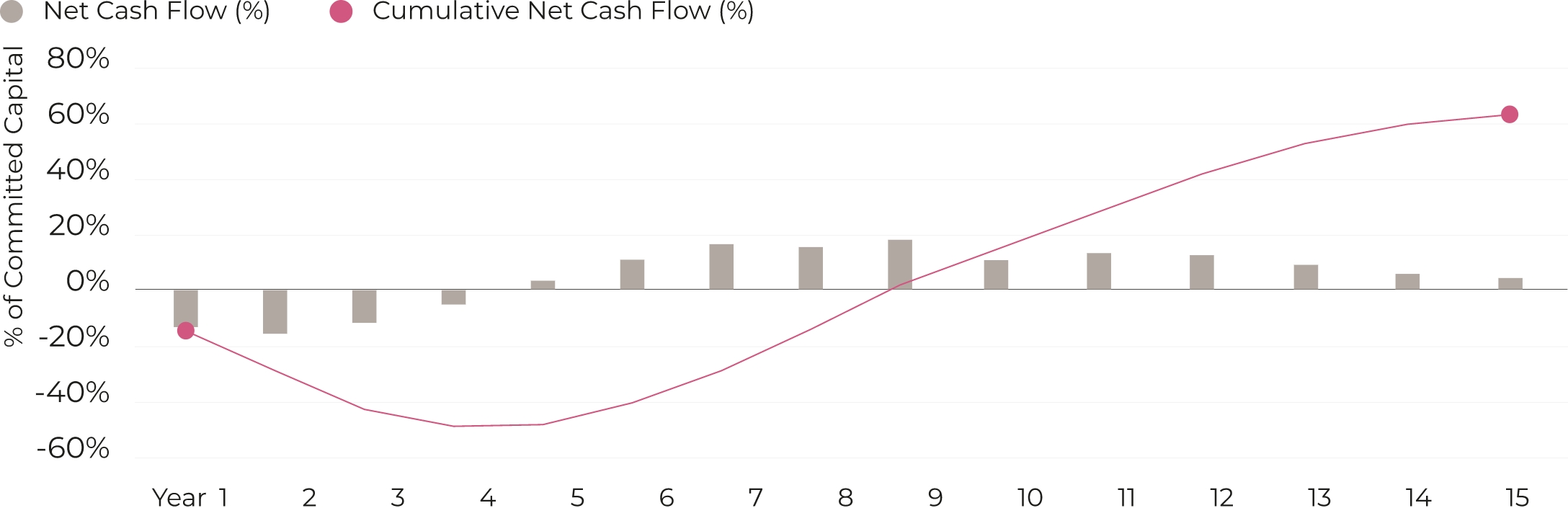

Commitment Strategy with Single Funds – 25% each quartile

Source: AltamarCAM Partners

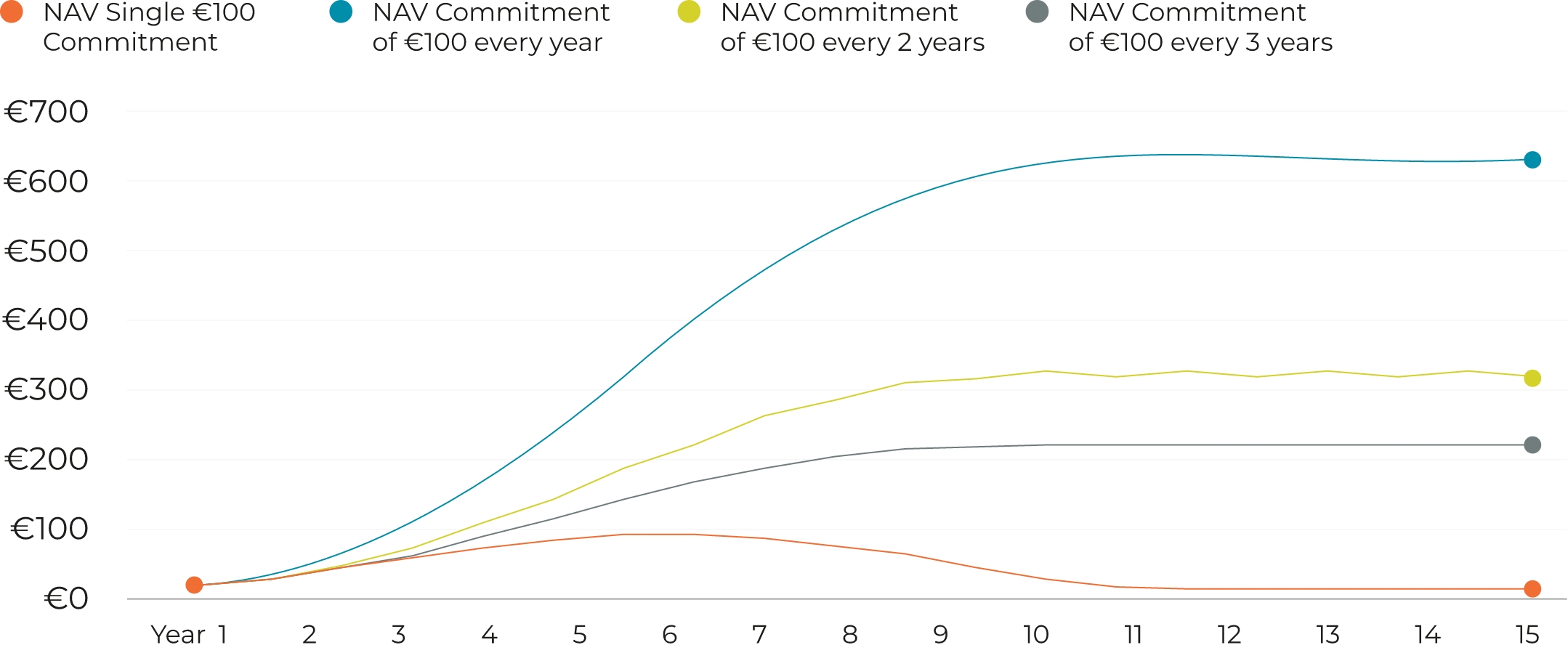

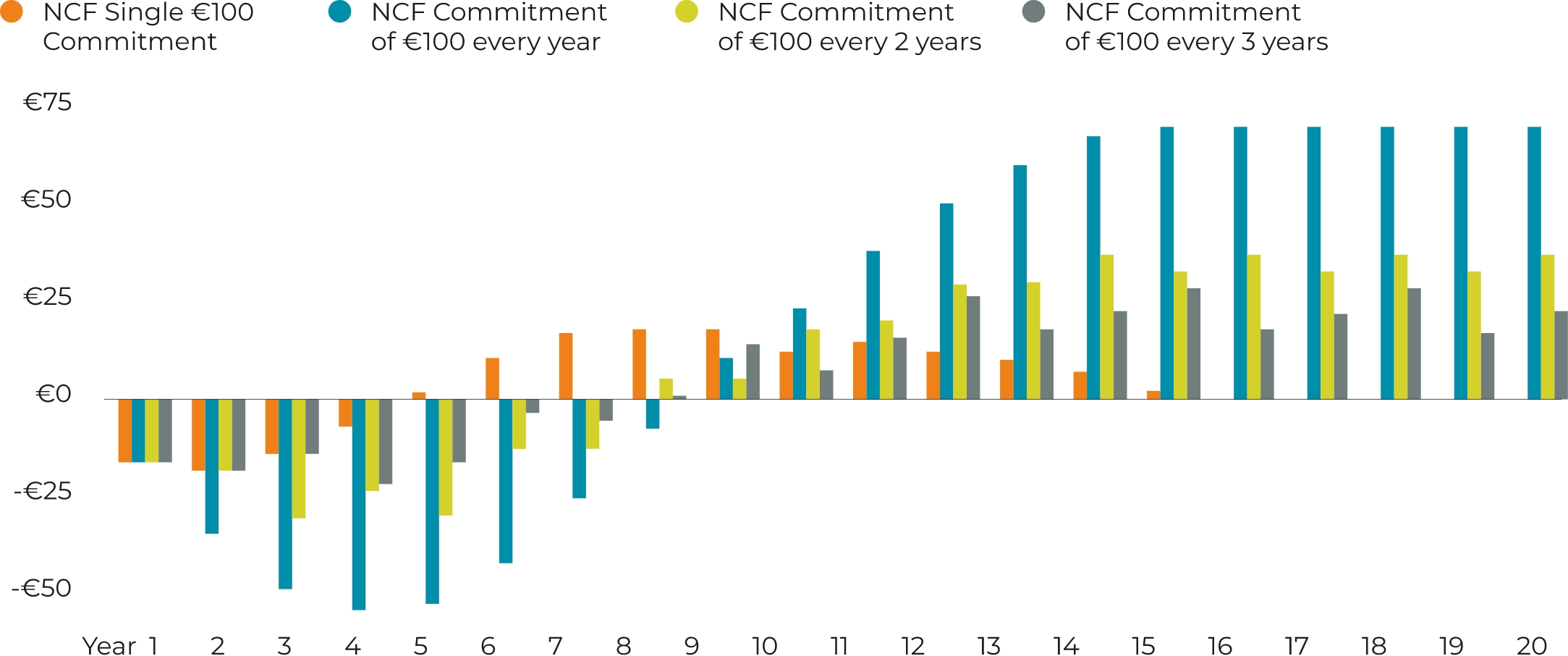

Investors may reach a target steady-state self-financing exposure by committing to invest, in round numbers, one sixth of the target exposure every year, one third every two years, or one half every three years.

As the last three strategies involve staggered investments, the desired exposure takes longer to build than by just committing the target amount at the outset, as in the previous example. However, once the target exposure is achieved with the three staggered commitment strategies, investors obtain annual positive net cash flows as long as the commitment strategy is maintained:

Commitment Strategy with Single Funds – Net Cash Flows

Source: AltamarCAM Partners

There are no shortcuts to building sustainable exposures in private assets. You need forethought and time to execute a staggered commitment strategy consistent with your unique portfolio goals and constraints.