Private debt in rising inflation and interest rate cycles

Across most developed and emerging economies, inflation has surged well above central bank targets. In the last twelve months to May, consumer prices rose to 8.6%, 8.1% and 9.1% in the US, the EU and the UK[1]. There is a growing concern that inflation may become persistent, fuel inflationary expectations, and lead to higher wage pressures that could push up inflation higher and for a sustained period.

Markets have reacted to this situation by pushing up interest rates. During periods of rising interest rates, fixed income investors are at risk of losing money due to the impact that higher discount rates have on their portfolios. They often react to this environment by reducing the duration (interest rate sensitivity) of their portfolios via the derivatives market or by reallocating their portfolios into short term bonds or the money markets. Private debt can help investors navigate a rising rate environment due to its floating coupon and the senior position on the capital structure of direct lending strategies.

Private debt offers investors an alternative to adapt their portfolios to a rising price and interest rate cycle given the floating rate nature of the loans underwritten by direct lenders. A floating coupon implies a duration lower than a comparable fixed coupon bond and thus, ceteris paribus, private loans to corporations can perform better than the typical fixed coupon bond when rates go up.

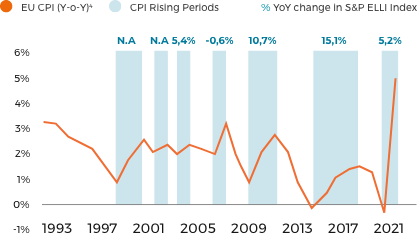

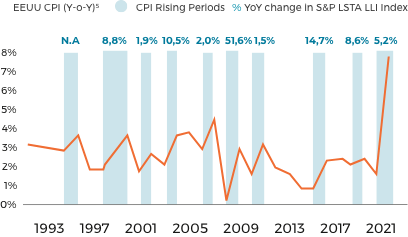

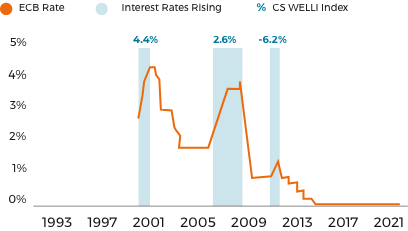

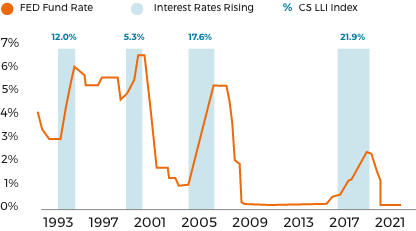

The following charts show how senior loans perform in scenarios where inflation and central bank rates increase. Given the scarcity of return performance data[2] for private debt, we use as a proxy to private loans the returns of senior loans, which have a similar structure and duration. The blue shaded areas present the returns of senior loan indices during times of accelerating inflation or rising interest rates.

Return generated by senior loans [3] during periods of accelerating inflation in the Eurozone

Return generated by senior loans during periods of accelerating inflation in the USA

Source: S&P, Federal Reserve Bank of St. Louis

Note: Past performance is no guarantee of future returns.

- The Economist; www.ec.europa.eu; www.tradingeconomics.com.

- There is not equivalent index for private debt direct lending returns in the Eurozone but there is an index in the US, the Cliffwater direct lending index published quarterly and that provides equivalent supporting evidence with positive returns during accelerating US inflation.

- Senior loan returns are measure using the Credit Suisse Leverage Loan Index and the Credit Suisse Western European Leverage Loan Index.

- Consumer Price Index: Harmonized Prices: Total All Items for the Euro Area, Percent Change from Year Ago, Annual, Not Seasonally Adjusted.

- Consumer Price Index: All Items for the United States, Percent Change from Year Ago, Annual, Not Seasonally Adjusted.

Return generated by senior loans when ECB´s monetary policy rates rise

Return generated by senior loans when the FED’s monetary policy rates rise

Source: Credit Suisse, Federal Reserve Bank of St. Louis, European Central Bank

The performance of loans during periods of accelerating inflation or rising central bank rates has usually been positive. Senior loans have indeed been among the best performing asset classes in 2022. Moreover, the Cliffwater Corporate Direct Lending Index exhibited a return to end of May 2022 of 2,4%, while almost every other fixed income asset has experienced losses in the same period. Nevertheless, if the rise in interest rates triggers a recession or an expectation of one, then the credit component of the return could negatively impact the performance of these loan investments.

What can we take away from this analysis?

- Due to the floating rate feature of private debt loans, this asset class is likely to perform better than other fixed income assets in periods when interest rates and inflation go up.

- This structural characteristic of private corporate loans helps explain why correlation with other fixed income assets tends to be low and thus, why adding direct lending funds to a fixed income portfolio can reduce the standard deviation of its performance.

- If the increase in central bank rates leads to a recession, the loan performance can suffer because of the credit risk component of its pricing. However, as direct lending sits at the top of the capital structure, investors are more protected against severe outcomes.

- Finally, on rising rate environments, refinancing options could be more limited and will be more expensive. This strengthens the importance of leverage discipline to mitigate restructurings. Conversely, one could hedge the risk of impairments by investing in stressed and distressed strategies. We will review these strategies in an upcoming newsletter.

Coping with the cycle through vintage diversification

Markets may endure volatility and severe corrections over the next few years. This will represent a challenge for existing mature funds planning to exit their investments and a great opportunity for new funds.

New funds deploying cash over the next few years through multi-year investment programs will be able to seize unique investment opportunities and harvest outsized illiquidity and complexity premia.

Valuation and yield-based expected returns of traditional 60/40 portfolios have collapsed. There is compelling evidence that there is no alternative to diversifying into liquid alternative strategies and private assets. However, investors are reluctant to deploy capital in these uncertain times.

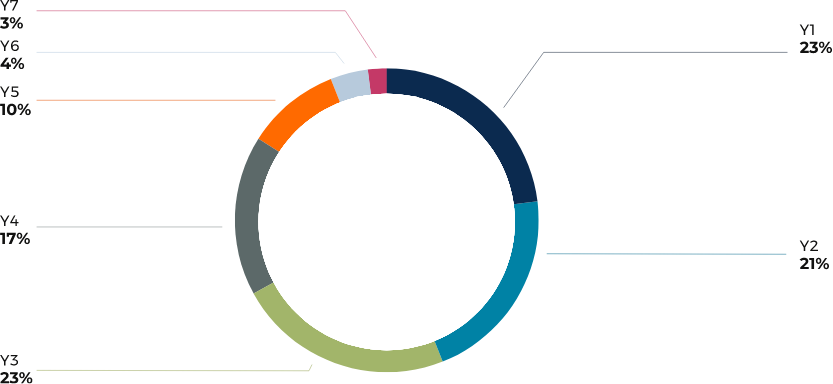

Direct single private equity funds do their best to get money working as fast as possible. Since inception, AltamarCAM has invested in 136 single funds. The median manager has deployed in the first two years almost 50% of capital actually invested[1]. These funds reached a 93% deployment rate at the end of year 5:

Year and Share of Investments – Direct Funds

Source: Based on all primary private equity comingled funds invested by Altamar Private Equity, S.G.I.I.C., S.A.U. since 2005.

1. Median percentage corresponding to 136 direct private equity funds in which Altamar Private Equity, S.G.I.I.C., S.A.U. has invested since 2005.

Without a proper vintage diversification strategy, investors risk investing a significant portion of their committed capital in the middle of a storm .

Fortunately, multi-year investment programs, such as those embedded in funds of funds and segregated managed accounts (SMAs), invest at a slower pace. It takes time for them to commit capital and even more time to deploy it.

As we can observe in the second pie chart, funds of funds have typically deployed just 19% of total invested capital over the first two years. It takes them up to 5 years to deploy 73%. Capital deployed thereafter represents a significant 27% of total invested capital.

Year and Share of Investments – Funds of Funds

Based on all primary private equity comingled funds invested by Altamar Private Equity, S.G.I.I.C., S.A.U. since 2005.

Note: Median percentage corresponding to 136 direct private equity funds in which Altamar Private Equity, S.G.I.I.C., S.A.U. has invested since 2005.

The deployment cycle is way far into the future, beyond the point we can accurately predict. If you overlay the deployment cycle with a proper commitment strategy, whatever happens to the markets over the next two to three years becomes immaterial. The only fear to consider is the fear of not following a properly thought-out investment strategy.

Don’t fear the markets. Fear not following a properly structured investment strategy.

Markets may endure volatility and severe corrections over the next few years. They will represent a challenge for existing mature funds planning to exit their investments and a great opportunity for new funds starting to deploy their cash.

New funds deploying cash over the next few years will be able to seize unique investment opportunities. Patient investors will be able to harvest outsized illiquidity and complexity premia.