About us

Key Figures

Investment in private assets rebounded in 2021, after a year of pandemic-driven turbulence, becoming increasingly important as a key strategy for global investment portfolios, with total assets under management of over $9.8tn as of June 2021

Specialized and selective

investment approach

+3,000

400 via 936 underlying funds

+10,000

Value creation

for investors

€6.8b

€4.0b

€7.9b

€5.1b

Alignment of interests

by investors of close to

€17.0b

by the AltamarCAM group

Over €280m

Note: Past performance is not necessarily indicative of future results since current economic conditions are not comparable to those that existed previously and may not be repeated in the future. Allt his information includes all the vehicles managed by AltamarCAM Partners.

AltamarCAM team

professionals

An independent group controlled

by the management team

AltamarCAM Partners’ shareholder structure

ESG Highlights

Reinforcement of the ESG governance model

AltamarCAM has strengthened its ESG governance model and the ESG Team, now made up of 6 cross-division team members, enabling efficient ESG workflow and strategy execution.

Carbon neutrality achieved

Carbon Footprint calculation and offsetting for scopes 1, 2 and reduced scope 3 (business travel and employee commuting) for 2019, 2020 and 2021.

Sponsorship role in the PRI in Person event

Event hosted in Barcelona with the mission of driving progress towards a more sustainable global economy.

Award: Fund of Funds Manager

of the Year in EMEA

AltamarCAM Partners has been recognised for the third year in a row by Private Equity International as the “Fund of Funds Manager of the year in EMEA”, as well as “2021 Firm of the Year in Iberia”.

Once again, we would like to express our sincere thanks to all those who continue to place their trust in us, especially in today’s challenging environment.

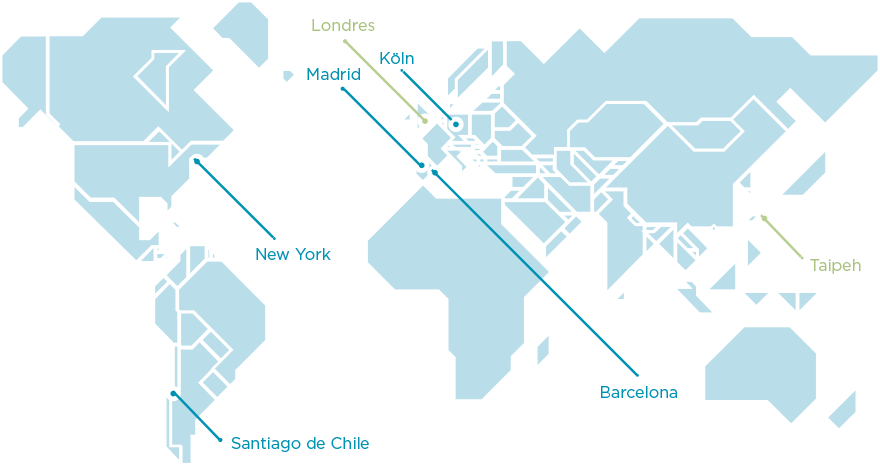

Global Presence

- Offices

- Representative office / visiting office

Our Values

At AltamarCAM we encourage a culture based on shared and long-lasting values, nurturing trust in all our relationships with clients, staff and society

Our clients’ interests are our number one priority. Only consistently adding value and doing what is best for our clients will we be able to earn their trust and enjoy success together in the long term

People are our most important asset. We look after our team. We encourage mutual respect, cooperation, diversity, open communication, teamwork, and work-life balance

We have a partner-based approach. The interests of all key stakeholders (management, shareholders and staff) aligned with those of our clients through our investments in the firm’s funds and capital. Our compensation policy is linked to the success of our clients

We always think in the long term. We build lasting relationships with clients, managers and staff

We seek excellence in all we do. Our commitment to excellence is based on the knowledge and experience of our team, the motivation and responsibility of each member of staff and our culture of continuous innovation

We act responsibly as a company and as individuals. As a company, we contribute positively to society and maintain the strictest ethical standards. As individuals, we act with integrity and conscientiousness in all areas of our lives

Structure

Board of Directors

The board of directors of Altamar CAM Partners SL, the AltamarCAM group’s holding company, is the high-level governing body of the organizational structure. It is comprised of executive and non-executive directors who align the strategies and goals of all group entities and monitor their results on a regular basis

It is comprised of the following members:

Co-Chairman

Director

Director

Domanial Director

Co-Chairman

Director

Director

Board Secretary

Director

Director

Domanial Director

Executive Management Committee

The main task of the Executive Management Committee is to monitor the strategic objectives and business plan established by the Board of Directors, in addition to other aspects of the day-to-day running of the firm not dealt with by other committees

It is comprised of the following members:

Co-Chairman

Co-Chairman

CEO

Co-Head Private Equity

& Chair of ESG

Co-Head Real Assets

Co-Head Real Assets

Chief Client Officer

Vicechair and Head IR Germany

Co-Chair Private Equity

Co-Head Private Equity

Head Germany

COO Germany

Co-COO Spain

Co-COO Spain

*Permanent Observers

Organizational Areas

Building trusting relationships with clients requires a holistic approach to excellence and innovation across all organizational areas of the firm

In 2021, the Corporate Development team focused on the execution of the transaction with CAM, in coordination with internal and external advisors and resources. The team provides support to the Board of Directors and the Executive Partners related to the Firm’s corporate governance, the monitoring of the markets and the analysis of potential growth opportunities.

The Finance department achieved important goals in 2021 related to the integration of the two businesses, such as completing the first audit of the consolidated group and integrating all the German companies into AltamarCAM´s monthly reporting. In order to strengthen the firm’s capabilities, the department has been consolidated with the creation of a new position (Global CFO) as well as the introduction of a new Financial Committee to support the new global scope of the Finance department.

In 2021, main strategic goals reached by the Portfolio Analytics team were increased data quality and transparency, reduced internal risk, and enhanced transparency in communications to LPs. This was achieved by providing (i) high quality and consistent portfolio data, (ii) CrossTeam Analytic Support, enabling every department to perform their essential analytical duties, and (iii) scalability and resource optimization through continuous efficiency improvements in process automation at every level without loss of quality.

The Funds Finance and Operations department has continued improving its processes and controls during 2021, creating a more scalable firm where operational risks are also better monitored and mitigated. The firm’s digitalization plan continues to improve the quality of administration services provided to clients. The introduction of the Global CFO position in 2022, coupled with the implementation of a new teamwork system, will further strengthen the department’s capabilities.

In 2021 and the first four months of 2022, the Talent team has liaised with the Cologne office partners to align the Cologne teams with the key processes of the firm regarding recruitment, career development and compensation. During this time the team has overseen the recruitment processes of 24 new full-time hires and 33 interns in the firm’s Madrid, Barcelona, New York and Cologne offices. The yearly talent review process and the 2021 endof-year compensation processes were managed in an integrated way, overseen by the Executive Management Committee. All the teams across all offices are now involved in AltamarCAM´s Training Program.

In addition to its daily responsibilities related to fund formation, regulatory matters and corporate matters, the Legal Department was particularly involved during 2021 in all legal aspects of the integration with CAM. This entailed a major effort of coordination, not only with external advisors but also with all the internal departments involved in the transaction (Finance, Operations, Compliance, etc.).

The AltamarCAM group has a robust and reliable internal control system, as evidenced by the reports of internal and external auditors as well as external experts on the prevention of money laundering and terrorist financing for the year 2021.

The Risk & Compliance department is currently working on harmonizing the group’s policies and procedures, incorporating best practices and ensuring an integrated control framework across the group.

The AltamarCAM team, thanks to the Facilities department, all gathered together physically for the first time in Toledo an offsite from May 18 to 20, 2022. More than 260 employees from the Madrid, Barcelona, Cologne, London, NYC and Santiago offices enjoyed the opportunity to share working sessions and leisure time while getting to know each other better.

In 2021 the IT department continued to enhance client experience with the new investor portal - a much more intuitive 24/7 platform where investors may access their investments and relevant documents. The team also leveraged the firm’s Business Intelligence capabilities to add new advanced online reporting capabilities for mandates. 2021 also saw the launch of an integration project between Altamar and CAM’s systems. Furthermore, significant resources have been allocated to cybersecurity and providing support for the high volume of video communications with investors and the remote working of the AltamarCAM team.

Senior Team

Talent

Facilities

Co-COO Spain

Funds Finance & Analytics

Funds Finance & Analytics

Funds Finance & Analytics

Co-COO Spain

Corporate Development

Chief Technology Officer

IT

IT

& Compliance Officer

CFO Spain

Global CFO

COO Germany

Corporate Finance

Risk & Compliance &

Corporate Finance

Chief Legal Officer

Legal

International Advisory Board

The main mission of this Board is to provide strategic advice to the Group, especially regarding: (I) the growth plan and internationalization; (II) the identification of key trends for the business and their implications; (III) the provision of knowledge, opinions and ideas in an impartial way, and (IV) the identification of new strategic opportunities

Senior Team

Board

Asia

International